Understanding the Basics of Home Loans

Definition of Home Loans

A mortgage which is another name for home loan, is a type of loan that individuals acquire from banks or financial institutions for purchasing a house. The borrower will receive a certain amount of money from the lender (the principal amount) to purchase the property.

Mortgages typically have an interest rate associated with them; this is the price of borrowing the funds. Principal and interest repayment collected cyclically envisaged in long term These payments will then continue until you have repaid all of the money you borrowed.

Converted your dream house in reality? Check out our home loans in Coimbatore to suit your requirements So help to help yourself by Taking that first step towards home ownership and securing your future today.

How Home Loans Work

With an home loan someone can buy a house when they do not have enough savings to pay cash for the house. If the application is successful, they are fully funded by the lender they selected and therefore able to buy the property they wanted.

When a borrower is handed the principal, they begin to repay in monthly instalments. Some will be applied to the principal, while another part will be used to pay for interest charged on the rest of the money to be repaid. Over time and as more payments are made, more money goes towards reducing the amount owed with less going towards interest.

Importance of Credit Score in Home Loan Approval

Creditors use credit scores to determine your credibility as a borrower. The higher the credit score, the better the chances of approval in larger amounts at lower interest rates.

For example:

Someone with a stellar credit score may be eligible for lower interest rates and higher loan amounts.

Somebody with lower or bad credit will generally cost more to service than somebody with stellar credit because the lender or leasing agency has to account for the higher risk.

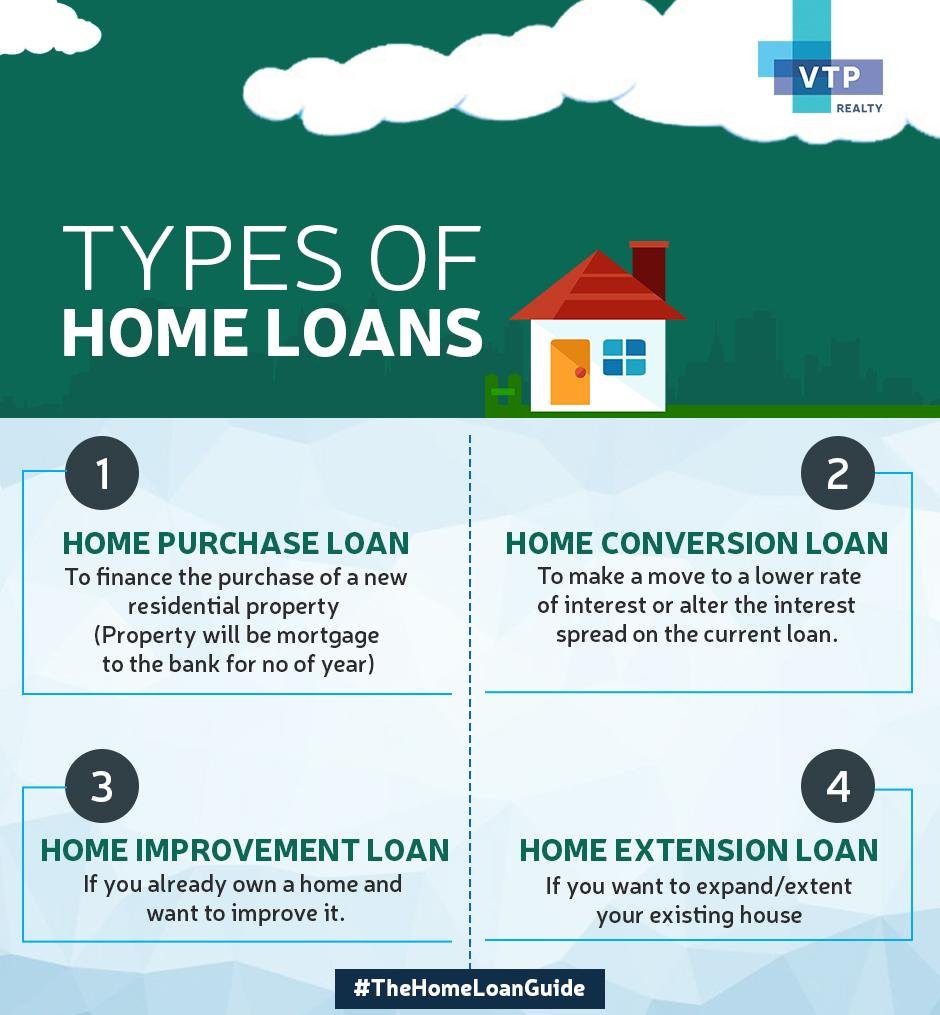

Overview of Home Loan Types and Features

Fixed-Rate Home Loans

1.With a fixed-rate home loan, the interest rate remains the same for the duration of the loan. This type is predictable and therefore easier for homeowners to budget.

2. A fixed-rate home loan will lock you in to an interest rate, which is both a positive and a negative, all depending on where the prevailing interest rates are when you take out the loan. But, initial rates may be higher than adjustable-rate mortgages.

3. This type of flexible loan also have the ability to allow homeowner to know their long term financial commitment. However, a drawback is that, should market interest rates fall significantly after taking out a fixed-rate mortgage, borrowers may be missing out on potential savings from refinancing.

Adjustable-Rate Home Loans

Adjustable-rate home loan, or variable-rate mortgage, the interest on which is linked to the prevailing market conditions. These loans often have lower initial interest rates than fixed-rate mortgages

Adjustable-Rate Mortgages As you may know, one of the benefits of adjustable-rate mortgages is that borrowers benefit from low payments when interest rates are low. Conversely, higher market interest rates can significantly raise monthly payments.

FHA (Federal Housing Administration) Loans

FHA loans are worker-supported loans that allow home buyers to secure a lower down payment requirement and have more relaxed credit score needs than a traditional loan. These just are good for this who are buying their first home and may not have many savings or an established credit platforms.

Accessibility is the primary benefit here, but keep in mind that FHA loans usually require private mortgage insurance (PMI), which will increase your total borrowing over time due to the fact that you will be paying additional monthly premiums along with your regular monthly mortgage bills.

VA (Veterans Affairs) Loans

The Department of Veterans Affairs only offers VA loans to active-duty service members and veterans. One of the biggest benefits, is that they usually won’t require a down payment or private mortgage insurance which makes them incredibly favorable for anyone who would like to buy a home without huge upfront costs or additional monthly expenses of PMI.

Eligibility Criteria for Obtaining a Home Loan

Factors Affecting Eligibility

In order to assess whether someone is likely to be able to handle debt and meet payments in a timely manner, lenders usually look at an applicant’s credit score. Having a well credit score is more likely to be approved for a loan than an unfavorable credit history or the loan may be subject to a higher interest rate. It also takes into account the borrower’s current debts and other financial responsibilities.

Another important consideration is employment stability which has a large bearing on whether or not a person is eligible to take a home loan. One of the vital factors that concern the lenders is the regular source of income as compared to the instability of employment. It is meant to make sure that the borrower has a steady source for repaying the loan throughout its term.

Minimum Income Requirements

If you are applying for a home loan then the lenders typically fix the minimum income constraints which the applicants should meet. This mandate is in place to make sure a borrower has enough of an income to pay for their housing costs (including the mortgage), and that they are able to stay under the maximum debt to income ratios which are set in place.

For instance, certain lenders may place a condition that the applicant should earn a minimum annual income, which can be at three times his or her annual repayments. It shows financial stability and increases the chances of a person applying for a home loan to get that loan sanctioned.

Employment Stability Importance

Knowing what you do is one thing but your lender wants to know that you have a MEANS of repaying the loan as well. Lenders want to know that the people who take out loans from them have stable jobs, because their ability to pay the loan depends on having a job.

For example, you are more likely to be positively perceived by Lenders as someone who has been working in the same company or industry for a set period, than as someone who has changed jobs on a regular basis or someone who was unemployed for long periods.

Advantages and Tax Benefits of Home Loans

Financial Advantages

Types of Interest-Only Home LoansInterest-only loans are created to be as flexible as possible and a good way to get onto the property ladder if you have limited capital or if you want to buy an investment home. This is good news for people or families looking to be homeowners because that means they do not need to wait years to save all that money.

By spreading the cost over a number of years, they can live in their own home and still pay back the loan in affordable sums.

Property investments with a home loan can generate long term financial gains. Over time, property values appreciate, and this in essence will cause homeowners to realize substantial profit if they decide to sell their property down the track. This appreciation potential is what makes getting a home through a home loan a lucrative opportunity for those who wish to grow their wealth long-term.

Tax Benefits

| Income Tax Act | Maximum Deductible Amount |

| Section 24 | Rs.2 lakh per annum |

| Section 80C | Rs.1.5 lakh per annum |

| Section 80EE | Rs.50,000 |

Some of the main income tax benefits of home loans are as follows: This is because homeowners can get tax benefits on the principal amount of the home loan & on the interest paid on the home loan, which means a whopping amount can be saved from home ownership.

Talking about home loan tax benefits, the principal component of EMI (Equated Monthly Installment) payments allow a benefit of deduction under Section 80C of the Income Tax Act, while interest payments qualify for deductions under Section 24(b) of the Act.

In effect, these tax benefits cause an individual’s taxable income to drop, reducing the overall tax incurred as a result, and allow more money to be available since the disposable income has been increased. For instances, some who are in a higher income bracket and have a heavy home loan can stand to save a lot in taxes with such interest deductions.

Long-Term Financial Security

While some of the immediate financial benefits of this include affordable monthly payment and future property appreciation, taking out a home loan provides financial security in the long-run by enabling individuals or families to obtain an asset that appreciates its value over time as well.

Mortgage Payment Unlike renting where monthly payments have no impact towards ownership (or equity accumulating), while paying down a home loan helps build equity defined as each payment lowers the outstanding balance owed on the property.

Calculating Your Home Loan EMI

Understanding Equated Monthly Installments (EMI)

A fixed amount a borrower pays regularly to a lender over a specific period of time to repay the loan is called an Equated Monthly Installment (EMI) It is the sum of Principal and Interest.

The principal is amount of money borrowed, and the interest is the charge for borrowing the principal. While paying your EMI every month, you are actually repaying part of the principal amount with interest on the outstanding balance.

The formula used for Home Loan EMI Calculation is as follows:

EMI = [P x r x (1+r)^n]/[(1+r)^n-1]

In which,

P = loan amount

r = rate of interest calculated monthly

n = loan duration in months

Factors Affecting EMI Calculation

The EMIs you will have to pay each month will depend upon multiple factors, which include:

Loan Amount: More the loan amount, more will be your EMIs

Interest Rate: Lower the interest rate lower will be the EMIs.

Loan Tenure: lower EMIs but higher cumulative payments with interests

Credit Score: A higher impeccable score would ensure lower interest rates and EMIs.

Recognizing these variables will aid you in making educated choices concerning what does it cost? you could pay for to obtain as well as pay back in a month.

Using Online Calculators to Estimate EMIs

Valley Real Estate Valley Real Estate Calculator So we have used online calculators to know that depending on different combinations of Loan Amount, Tenure and applicable Interest Rate, what will be your probable Home loan EMI. The murder weapons provided almost instant delivery of different scenarios which allowed the borrower to know how much they were biting off before taking on loans.

As long as the loan amount, term in years or months, and interest rates are input in an online home loan or mortgage calculator, and presto, a borrower can know immediately the estimated monthly installment corresponding to his or her requirements.

Applying for a Home Loan Online

Convenience

There is no other way how you can benefit as much from a home loan as applying it online. It is counterintuitive to think that a bank visit can be replaced with sitting inside the four walls of their dream residence. That means no standing in long queues or having to take time off work to pop into physical branches.

Electronic application processing means that prospective borrowers are able to provide the necessary documentation at any time of the day or night, with no need for them to meet with loan officers during regular banking hours. However, by one click, applicants can actually monitor their application on the system and get notified on the process of their loans without having to visit the bank severally.

Accessibility

Key benefit of home loan application online – Accessibility Geographical borders are irrelevant while various lenders such as banks and other financial institutions can be found by each person.

This provides an opportunity for the borrowers to look for alternative options to get better interest rates and other terms and conditions according to their financial need.

Required Documents

In general, you will need some basic documents as you apply online for a home loan. These may include,

- Identity proof (Adhar card or passport)

- Address Proof (utility bills etc.)

- Proof of income (eg payslips, tax returns)

- Document related to property }}> Agreement of sale, NOC from builder

Other Documentation: depending on the lender and the specific kind of loan, you will need to provide additional paperwork such as basic home improvement loan, land purchase loan or construction loan.

Prepayment and Top-up Options in Home Loans

Benefits of Prepayments

There are certain benefits of making prepayments on a home loan.

1. Reduces Interest Burden on Loan Firstly, it lowers the overall interest burden of the loan. Borrowers by paying more than minimum payments towards their principal actually reduce the outstanding that is interest bearing

2. One more benefit of prepayments is that it could help the borrowers to complete the tenure of their home loan faster. Regularly making extra payments can drastically shorten the total repayment timeline for individuals. This saves them not only a lot of money but also gives them financial freedom much earlier than they had expected.

3. In addition, by paying prepayments, you can increase your equity in your home faster. It allows them to own a larger percentage of their house because with each extra mortgage payment, a portion of the principal amount decreases aggressively.

Understanding Top-up Options

1. These top-ups are in effect extensions of existing loans and are typically sought for purposes such as communicating higher education expenses or redeveloping one’s home.

2. Since these lenders have a history and relationship with the borrower, they offer these top-ups at some of the most attractive rates in the industry and are confident about the borrower’s ability to repay based on their history of repayments and payments of instalments.

3. This process requires very little documentation as compared to taking a new loan outright, and thus comes handy when you want to access funds quickly without having to go through the long approval process all over again.

Impact of Prepayment on Reducing Interest Burden

Homeowners can understand the long-term benefits by understanding while prepayment impacts reducing interest burdens.

This method also helps to limit the effects of market conditions by reducing exposure to fluctuating interest rates as time continues.

Renting vs. Buying a Home with a Loan

Financial Comparison

However, renting vs owning a home with a loan usually comes down to financials. While renting, you the borrower are paying rent month after month but are not building any equity. In contrast, purchasing with a mortgage helps home buyers to own an asset and increase the value of the asset with time.

When buying with a loan, you must repay the borrowed amount in full over an agreed-upon time period, generally 15 or 30 years. Over the course of this time, borrowers can build equity in the home while also realizing the possibility of appreciation in its value.

Long-Term Benefits

The overall benefits of ownership with a loan over simply being a renter are huge over the long haul. As rental rates continue to rise, renters who do not lock in a mortgage payment will continue to pay increasing monthly installments putting those with a mortgage locked in at a significant advantage as they can enjoy stable housing expenses during the entirety of their loan tenure.

In addition, you can benefit from the appreciation in the value of the property if you own real estate through a loan. Homeowners tether themselves to shelter and their investment ebbs and flows with the housing market circuits.

Factors to Consider

When it comes to loans, and whether to rent or buy, there are plenty of things to consider. These include

1. List of all of your personal finances (credit score, ability to put a down payment down, etc.)

2. Career future employment stability, or potential moves

3. Local real estate conditions including cost of a property and rents

4. Personal needs for lifestyle options and housing.

Best Practices for Securing a Home Loan

Improving Credit Score

you are required to enhance your credit score before applying for a home loan. Key steps include paying bills on time, paying down debt and checking credit reports for inaccuracies.

Credit scores are subtly effective by having regular, on-time payments and a lower debt to income ratio, in that it can help to save you interest offer better rates on loans.

Researching Lenders

Using the example: I need to research and compare home loan providers. This provides borrowers with the ability to shop around for loans and pick the one with best interest rate, terms and conditions that work for his financial situation. By reviewing offers from multiple lenders, borrowers have a choice in which offer they want to go with.

Looking for more financial flexibility while securing your home loan? Explore our guide on personal loans in Coimbatore to find the perfect solution for all your financial needs.

Summary

To Sum Up Coming back to the point: This guide talks about everything you would want to know about home loans; right from their basics to the types available, the eligibility criteria, the features, your EMI calculations, the process involved, the options for prepayment, and the best practices involved. This article has provided readers with a concise overview of what is needed to acquire a loan to buy a house and what various factors may impact that process in a way that allows those interested in buying a house with the decision-making and knowledge needed to transcend the complexities of owning a home.

Frequently Asked Questions

What are the different types of home loans available?

Home loans come in many shapes and sizes: Fixed-rate, adjustable-rate, FHA, VA and (for rural residents) USDA. All types have their own benefits and prerequisites.

How can one calculate their home loan EMI?

For calculating your home loan EMI (Equated Monthly Installment) use the formula: EMI = [P x R x (1+R)^N]/[(1+R)^N-1] where P is the principal loan amount, R is the monthly interest rate & N is the number of monthly instalments.

What are the tax benefits associated with home loans?

Section 80C: Deduction towards principal repayment (for home loan borrower only); Section 24(b): Deduction towards interest payment (for both home loan borrower and property owner). Treat distributions as ordinary income based on the way you paid for the account but still take advantage of other qualified distribution tax benefits.

Is it better to rent or buy a home with a loan?

The choice of renting or buying an a home through loan should be made depending on a personal situation, such as financial security, long-term plans, rewards from the property market and personal choice. Affordability and future investment opportunities are just a few factors to take into account.

What are some best practices for securing a home loan?

To minimize the costs of buying a home, buyers should work to maintain a good credit score, save for a down payment, shop around with multiple lenders to get a good rate, and understand the cost of processing fees.