Want to improve your CIBIL score? Knowing how to increase score has become vital for financial stability. While taking a credit Or elevating your credit rating for loans or not less than saving money with the aid of getting better hobby rates, it’s important to have an excellent CIBIL score.

1. Understanding the Importance of a Good Credit Score

Loan Approvals

If you plan to take a loan, a high credit score is a must. If you have a high credit score, banks will not hesitate to approve your loans. If you are residing in Coimbatore and want to buy a car, take a loan against property or apply for a personal loan in Coimbatore then having a good credit score is important.

A poor credit score can make it difficult to get a loan. You are likely to be considered high-risk by lenders, and may not get loans. This may reduce your ability to purchase or invest in properties, etc.

Favorable Interest Rates

A good credit score might mean the difference between your loan application being approved or denied – and can help you snag a more favorable interest rate. The higher your credit score the lower the interest rates on the money you borrow as lenders are more generous when you have a high credit score.

On the other end of the spectrum, lenders might offer to dole out higher interest rates if you have low credit scores, as lending you money would be considered riskier because of your less-than-stellar financial background.

Assessing Creditworthiness

Your credit score is one of many factors in determining your credit worthiness, i.e. how likely you are to pay back a borrowed sum of money based upon your past borrowing.

It is important to understand how different elements of your financial decisions affect your score as you work to improve it. For instance, reducing your outstanding balance and making payments on time can improve your financial health and have a positive effect on your CIBIL score.

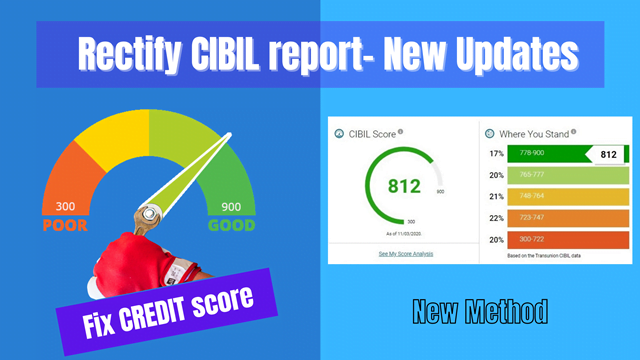

2. Rectifying Errors in Your CIBIL Report

Regularly Check

Under such circumstances, it is important to keep your credit report in the loop for any errors. If you are not checking your report often mistakes can occur and may go unnoticed. By monitoring it, you monitor misconfigurations from the start.

Occasionally, they may have credits crossed with someone else, or they may have received incorrect data on your credit activities. They could include a loan you did not take out or a missed payment that you paid for.

Dispute Promptly

In case you notice some discrepancies in your CIBIL report, make sure you contest and resolve them as soon as you can. You then have to dispute these errors which consist of contacting the credit bureau and providing proof of your claim.

Resolving a dispute usually involves submitting documents like bank statements or receipts as proof that the information on your credit report is false. When a credit bureau has this new information, they will then look into the matter and will correct it if there is an error.

This way it wont impact your credit score negatively, by fixing these faults. Small errors matter greatly to the determination of your creditworthiness by lenders.

Key Takeaways

Checking on a regular basis is good for recognizing errors early.

Turn to error swiftly

The evidence, of course, is key in litigation.

Fixing deficiencies could keep credit score from dipping.

3. Timely Payment of EMIs and Bills for a Better Score

Importance of Timely Payments

Paying your bill and EMIs on time is important and reflects in the CIBIL score. Failure to pay on time can utterly destroy your credit score, making it incredibly tough to obtain loans or good borrowing conditions in future. If you fall behind on due dates, you may go past due days, end up struck with late fees, penalties, and interest from banks or card providers.

Setting Up Automatic Payments

Having automatic payments for your bills and EMIs is one way that makes sure that you do not miss any payments. However, they also include a feature that allows the payment to be withdrawn automatically from your checking account on the specified due date. This ensures you never miss a payment due date or lose out on unexpected delays in the process of your transaction going through.

4. Managing Credit Utilization for a Higher CIBIL Score

Understanding Credit Utilization

Credit utilization is the percentage of your available credit that you are using. The credit utilisation ratio Should be kept below 30% to have a good credit score. This means if you have a credit limit of $10,000, you generally want to keep your balance no higher than $3,000.

Strategies for Improving Credit Utilization

A credit utilization ratio can significantly help improve when you increase your limit This way, even with the same spending, the increased limit will automatically lead to a lower usage percentage.

Another tactic is to either eliminate your existing balances or spread them around among multiple accounts, rather than have one account that is very nearly maxed out. For example:

If you have 2k every month in two credit cards

However, if they combine their expenses onto a single card and then spend 1K on each card (25%)

5. The Role of Credit History Length on Your Score

Demonstrating Responsibility

CIBIL Scores depend heavily on Credit History. It shows you can carry responsibly credit for a long time. If you’ve had a credit card for several years and have been good about making payments on time, that plays in your favor.

Impact of Closing Accounts

This may impact the length of your credit history and thereby your CIBIL score to a great extent. Hence, when you close an account, especially one with a long-standing positive payment history, you decrease the average age of your accounts. As a result, this can potentially affect your credit score overall.

Building Positive Credit History

For those struggling with a bad CIBIL score, it is important to build a positive credit history and maintain it in the long run. Showing that you have been making on-time payments on any type of credit that you’ve had for many years – whether it be loans or credit cards – can indicate that you are responsible with debt.

This way good long-term financial credibility can help in contributing to developing a positive impact on the CIBIL rating.Timely Payments: Using a variety of credits like installment loans (car loans, mortgages) along with revolving credits (credit cards), and paying them off on time can help in building strong long-term financial credibility which can, in turn, improve their CIBIL rating.

6. Diversifying Forms of Credit to Build History

Types of Credit

A divergent variety of credits such as credit cards, loans, mortgages can soar up your CIBIL score to a more stable height. This diversity showcases your capability to manage multiple forms of debt efficiently.

Using different kinds of credit, such as installment and revolving credit, illustrates your ability to balance a broad range of financial responsibilities with discipline. For example, while it is not preferable to have a few credit cards and a car loan, demonstrates that you can manage different payment terms and interest rates.

Applying for New Credit

Diversifying by applying for new types of credit is a good technique to diversify your credit portfolio. Applying for a new form of credit – like a home loan or personal loan with a creditworthy lender or bank – adds variety to your borrowing history.

Moving on to new debts such as secured or unsecured loans with a balanced repayment pattern across all will project a better finacial management reprisentation. So, if the only sort of debt you have carried in the past is on your credit cards and you are thinking about buying a home, or an auto loan, this step broadens the types of debts listed as part of your credit file.

7. Maintaining a Healthy Mix of Credit for a Better Score

Importance of Different Types of Credit

In order to increase your CIBIL score, it is imperative that you should have a well-balanced and diverse mix of credit accounts such as mortgage, auto loans, and credit cards. It shows that you belong to handle many financial responsibilities. For example, installment debt (like home or auto loans) plus revolving credit (like credit cards) shows that you are able to handle different kinds of borrowing.

One best practice is to not to take different types of accounts with the exact period. This is considered risky behavior and could lower your credit score. Lenders prefer to see a healthy mix of spend across different types of credit rather than a huge surplus of just one kind

Managing Your Credit Mix Wisely

However, to increase your CIBIL score, you should make sure, you have a good blend of different types of credit accounts. For example, you only have a credit card debt but don’t have any other type of loan or mortgage, that might affect the diversity aspect of your credit history.

Another thing to be mindful of is the balance-to-limit ratio across all open accounts. The utilization ratio is a strong factor that will determine whether you are eligible to avail of the credit. This can help your score because keeping that ratio low, showing that you are not maxing out any one card or account, makes you look like less of a risk.

8. Regular Monitoring and Maintenance of Your CIBIL Score

Importance of Regular Monitoring

When you can review your funds based on your credit report, it gets very much clearer. Monitoring your CIBIL score helps you to fix the changes that may have a negative effect on your credit score and act on them. For example, if there are mistakes in your report, like late payments that you did not make or accounts that aren’t yours, trying to fix these as soon as possible can keep your score from falling any further.

It also gives you the ability to monitor for possible cases of identity theft or fraud. Whether you see unknown accounts or unauthorized inquiries on your credit report, it is important to act at once to keep your financial reputation clean as well as protect yourself from long-term repercussions.

Proactive Credit Repair

This is considered best practice as it allows you to always be in the loop from your end that you are being tried for, and you will also ensure your financial health upfront. That involves keeping up with what exactly is affecting your credit score and fixing any immediate issues.

For instance, you reveal that high credit card balances has a negative impact on your score – your effort to pay down those balances will reflect favorably over time. Similarly, observing missed payments or defaults displayed in the report, you can address these problems and your CIBIL score might increase soon.

9. Strategies to Enhance Your CIBIL Score from 600 to 750

Consistent Payments

Ensure that you pay your accounts punctually each and every month. This can help to gradually build up your credit score. Missing a payment can be devastating to your credit so be mindful of your due date.

Consistency is key. Paying your bills on time helps you show that you practice good financial habits and engages in building your credit history.

Apart from the above, lowering your outstanding balances also plays an important part when it comes to enhancing your CIBIL score. Paying off your loans allows you to decrease the amount of credit you are using and demonstrate to creditors that you are responsible with your own financial.

Credit Utilization

Maintaining low credit card balances also plays a significant role in helping you achieve a healthier CIBIL score. You should also aim to stay well within your credit limits as using it all can look like a sign of financial distress, and this could also knock points off your score.

Using just a small portion of the credit available to you on each card demonstrates that you’re not too dependent on credit and are able to manage it responsibly. This will show responsible borrowing and can help improve your credit score.

Are you willing to purchase the home of your dreams and feeling tensed as you have always been fussy about your CIBIL score? Find the right home loans in Coimbatore to make your dreams come true at attractive rates and flexible terms.

Closing Thoughts

To sum up, erasing those black marks from your credit score is a long-drawn task that need to be done through a single prism of every financial transaction that is there on any credit bureaus data base. Correct the errors in your CIBIL report, make sure that you pay your EMIs and bills on time, manage your credit to avoid overspending, and have a balanced mix of credit.

Additionally, diversifying the type of credit you use and keeping tabs of your credit at regular intervals also contribute. This can really help persons to improve their CIBIL score from 600 to 750 and avail good financial opportunities when required.

Frequently Asked Questions

Why it matters to have good credit scores

A good credit score is something that can benefit you in your life, improve your ability to get loans, credit cards and low interest rates. It also demonstrates fiscal maturity, which can result in lower insurance rates and rental prospects.

What steps can I take to rectify errors in my CIBIL report?

In case there are any discrepancies in the CIBIL report, one must file a dispute with the credit bureau and also ensure that it has been corrected.

Why is timely payment of EMIs and bills important for improving my CIBIL score?

Paying your EMIs and bills on time is a good sign of financial-discipline. This goes a long way in helping you to improve your CIBIL score, by exhibiting that you can be trusted to meet your financial liabilities.

How does diversifying forms of credit help build my credit history?

Types of credit (10%): Diversifying types of credit includes using an array of different credit accounts (i.e. installment loans, revolving accounts and retail accounts). This mix signals to lenders that you are able to juggle different kinds of debt and manage each responsibly.

What strategies can I use to enhance my CIBIL score from 600 to 750?

Examples of strategies include paying dues promptly, keeping current credits at a low balance, avoiding applications of multiple new credits all at once, validating the information in your credit report on a regular basis, keeping old accounts open unless absolutely necessary. []