When you face financial difficulties and decide to take a loan, this time a personal loan can help you to get instant money. But if you don’t do enough research then you face personal loan risks as well. When applying for a personal loan, there is a lot to know. How does a personal loan vary from more well-known forms such as home and car loans, for example? For what purposes might personal loans be used? Do personal loans have any benefits?

Before applying for a personal loan, think carefully about your reasons. Why is the personal loan needed? Is it for an emergency, like medical bills, or a planned expense, like a wedding? Understanding your purpose will help you decide if this is the right option. Always compare your loan options, including interest rates, repayment terms, and fees. Ask yourself: Is a personal loan good for you? While these loans offer benefits like quick access and flexibility, consider the personal loan risks, such as higher interest rates. Proper evaluation ensures a sound financial choice.

Highlights

- Personal loans are flexible and can be used for emergencies or planned expenses like weddings and medical bills.

- A good credit score increases approval chances and helps secure lower interest rates.

- Interest rates can be fixed or variable; understanding their impact is crucial for financial planning.

- Hidden charges like processing fees and penalties can increase the overall loan cost.

- Comparing lenders ensures you find the best terms, interest rates, and repayment options.

What Is a Personal Loan?

A personal loan is a loan without security that allows you to fulfill a variety of financial tasks, such as medical emergencies, weddings, or other personal costs. Personal loans can be used for last-minute or urgent circumstances since they do not require collateral, unlike home or car loans. They are flexible, simple to obtain, and adjustable to your capacity to repay. To make sure you manage the loan properly, it helps to understand the conditions, interest rates, and payback schedule. When used properly, a personal loan may be a useful financial instrument. Collateral is not required, unlike house or car financing, which makes it perfect for last-minute situations.

Key Considerations Before Taking a Personal Loan

To make sure a personal loan is the best option for you, it’s necessary to know a few things before applying for one, whether it’s for a wedding, an unexpected medical need, or buy something for the family:

Credit Score:

When you apply for a loan, one of the first things that banks look at is your credit score. A better score increases your chances of being authorized for the loan and receiving a reduced interest rate. Before applying, consider modifying your spending patterns or paying off any debts if your score is poor.

| Credit Score Range | Creditworthiness | Approval Probability |

| Below 600 | Urgent Action Needed | Low |

| 600-649 | Doubtful | Difficult |

| 650-699 | Satisfactory or fair | Possible |

| 700-749 | Good | Good |

| 750-900 | Excellent | Very High |

Interest Rates:

Interest rates come in two primary varieties: variable and fixed. With a fixed rate, you can more easily plan your payments because they remain constant for the duration of the loan. Depending on the state of the market, a variable rate might fluctuate over time, thereby increasing your future costs. Always be aware of the interest rate type you are receiving and how it will impact the amount you pay back on your loan.

| Bank | Interest Rate (p.a.) | Processing Fee |

| HSBC Bank Personal Loan | 9.99% p.a. – 16.00% p.a. | Up to 2% |

| HDFC Bank Personal Loan | 10.75% p.a. – 24.00% p.a. | Rs.4,999 + GST |

| IndusInd Bank Personal Loan | 10.49% p.a. onwards | Up to 3.5% onwards |

| ICICI Bank Personal Loan | 10.85% p.a. – 16.25% p.a. | Up to 2% |

| Yes Bank Personal Loan | 11.25% p.a. – 21% p.a. | Up to 2.5% |

To know More about Personal loan interest rate for various banks

Hidden Charges

A few loans have unknown costs, such as late payment penalties or processing fees. Your loan may end up costing more than you planned due to these factors. Ask the lender about any additional fees and make sure you thoroughly understand the loan agreement.

| Charge Type – Personal Loans | Details (market standard details) | Charge Type – Personal Loans |

| Processing Fee | Up to 3% of loan amount + applicable taxes | Processing Fee |

| Repayment/EMI Bounce Charges | Charges- 500 – (<5lac)1000 – (5 – 50 Lacs)1500 – (>50Lacs – 2Cr)2000 – (>2Cr) | Repayment/EMI Bounce Charges |

| Penal Charge/Late Payment Charge (LPC) | 2% per month (p.m.) on overdue EMI + applicable taxes**LPC revised from 3% to 2% per month on overdue EMI w.e.f. 4th Dec 2023*Taxes applicable on LPC w.e.f. 1st April 2024 | Penal Charge/Late Payment Charge (LPC) |

| Part Prepayment Charges | Up to 5% of the prepaid amount + applicable taxes | Part Prepayment Charges |

| Foreclosure Charges | 5% of principal outstanding + applicable taxes | Foreclosure Charges |

Repayment Terms

The duration of your loan is also crucial. Your monthly payments (EMIs) will be greater if the loan period is shorter, but you will pay it off sooner. Longer loan terms result in lesser monthly payments, but over time, the overall amount of interest paid will increase. Choose a loan term that works for your spending plan.

- Annual percentage rate.

- Application fee/ Processing charges.

- Loan agreement.

- Principal amount.

- Term/ Tenor.

- Automatic payment.

- Loan prepayment.

- Balance transfer.

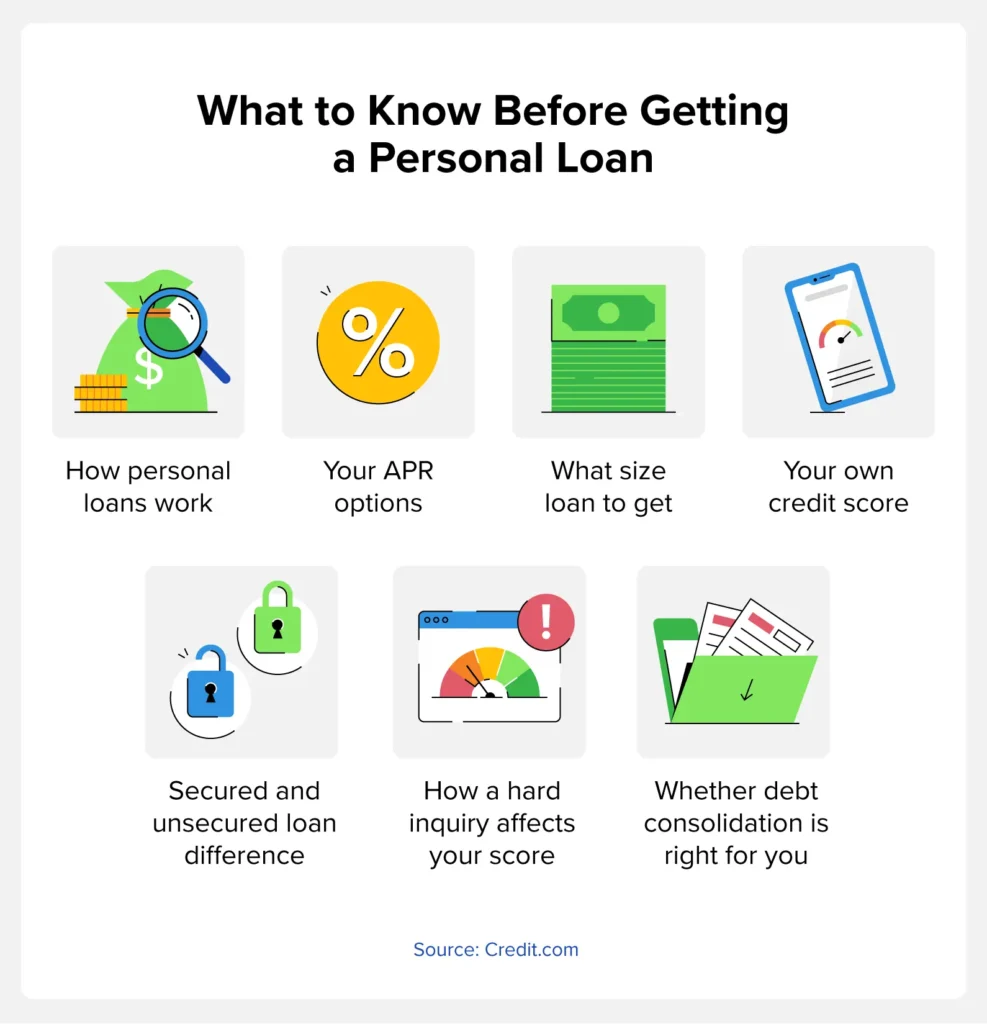

Things You Should Know Before Applying for a Personal Loan

To make a smart decision, it’s critical to collect all relevant information when applying for a personal loan. Before applying, take into account the following eight factors:

Evaluate the Total Loan Cost

- The whole cost of the loan, including interest and fees, should be taken into account in addition to the loan amount. Make sure you are okay with the entire payment amount and compare offers from several lenders to locate the best deal.

Eligibility Criteria

- There are certain qualifying conditions for each lender, including a minimum income or work status. Before applying, confirm that you satisfy these standards to prevent pointless rejections.

Loan Purpose

- Give a detailed explanation of your financing needs. Knowing why you need a loan—whether it’s for a personal project, a medical emergency, or debt consolidation—will help you select the best one and make sure you only take out what you need.

Compare Lenders

- It’s important to compare conditions offered by several lenders before agreeing to a loan. To select the loan that best fits your financial situation, compare interest rates, fees, payback periods, and eligibility conditions.

Conclusion

You can make smart financial choices if you know what a personal loan is and its benefits. Check loan rates, compare lenders, and keep clear of common errors like ignoring hidden costs. Plan your loan repayments carefully and consider why you need the money.

You may simply handle personal objectives, company requirements, or issues with the correct personal loan guidance. Select a loan based on your financial situation and needs. To reduce stress and take advantage of flexible finance, make well-informed selections. Now is the time to take charge of your financial future.

Ready to take control of your finances? We will help you find the best Personal Loan. We discuss all possible details that can help you Thank you