Understanding the Basics of Loan Against Property

What is a Loan Against Property?

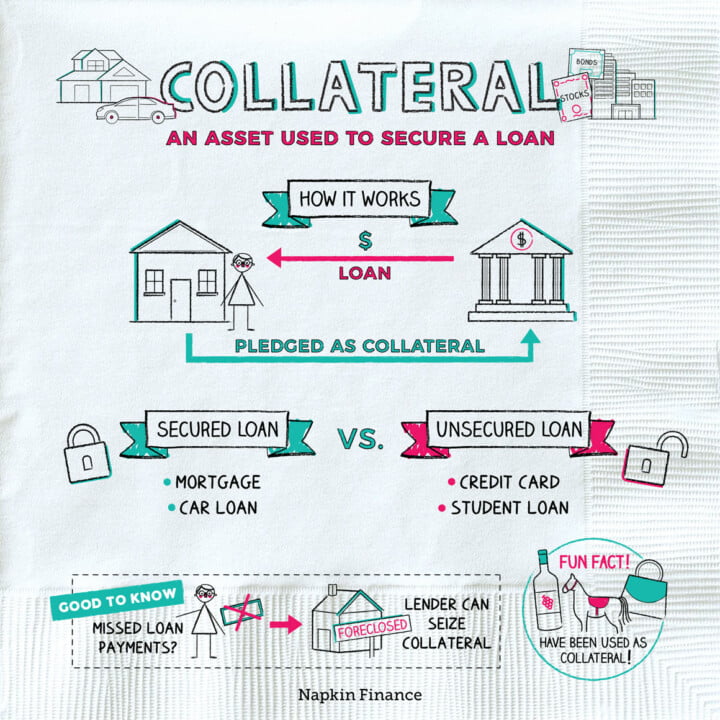

Loan against property is a type of secured loan, in which, the property of a borrower is hypothecated to the lender to ensure that the borrower is able to repay the loan. As a result, if the person borrowing the money does not pay back the loan, the bank can seize the property. Laredo Title Loans are secured loans, which means that you should offer something as collateral to the creditor before your title loan application gets accepted and processed. The value of your property and its market value usually determine the total amount that you can borrow.

Able to Secure it all on Your Home with Financial Independence? Find out more about our customized personal loan in Coimbatore whatever your requirements. Raise the money you need for your home without losing ownership of it Move one step closer to your financial future!

This type of loan is for people to use their assets without selling their properties. The ability to draw on significant funds for a number of applications, including

- Business expansion

- Education expansion

- Medical emergencies

Types of Properties Acceptable as Collateral

Different types of properties can be used as collateral. These may include ,

- House

- Apartment

- Commercial Property

- Residential Properties

Both the value and the location of the properties play a well-built role in defining the highest amount of loan that an individual can secure.

An example of this would be that of a prime location commercial space in a well-developed city which can get a higher valuation compared to agricultural land located in almost barren areas; a prime location commercial space in the best metro city when matched up agricultural land in no man’s land.

Maximum Borrowing Limit Based on Property Value

There are various factors on which the loan amount you can borrow through a loan against property depends such as income stability, credit score, age, etc and most importantly the current market price of your property. Lenders normally charge up to 50%-60% (or more) of the total amount of the property in the form of a loan offer as decided by them.

For example:

So if lenders have valued this in your residential house, they will not lend you more than 60% on that and the maximum you could get say is a loan of Rs 10,00,000

Commercial properties have larger loan percentages mainly because these properties are income-generating assets which makes them highly desirable collateral by lenders.

Eligibility Criteria for Availing Loan Against Property

Income Requirements

For this loan, individuals can borrow by providing a steady income as only income earners are entitled to a loan against property. Lenders generally require a minimum income level to qualify a borrower to pay off a loan. Different lenders have different requirements for income, although with the high loan amount it is higher in general than other types of loans.

For example:

For example, in order to get a loan against his property, Mr. Smith has to show that he earns at least ₹25,00000 annually.

In addition, some lenders may also take into account the debt to income ratio which is the divide between the monthly income of a how much they pay in debt each month. This allows them to determine if the applicant has enough residual income after all current financial obligations are met.

Property Ownership

For those looking to avail a loan against property, its very essential to be aware of the possible grounds of ownership when it comes to property acting as a collateral any time. Over the past, lending institutions will accept only self-owned properties or properties co-owned by one of the family members as the collateral.

For instance:

Mrs. Ravi intends to mortgage his own house for taking a loan against property from his bank.

Should the owner themselves owe certain amounts on the property that is being used as collateral for the loan or mortgage, this could make the property ineligible for the loan as the property is by default, not in the clear with zero debt/liens associated to it and lenders viewing properties that are debt/lien free or seeing less risk.

Age Limit

Whoever applies for a loan on the property should take care of the age restrictions imposed by lending institutions. This means the borrower must not exceed the maximum age of loan maturity in most banks (different for banks) as the bank must be ensured, the borrower has enough working years left before the retirement age as per their policy.

For instance:

Refer Example 2: Mr. Patel is 45 years old and he is going to take a loan against his residential plot, he needs to verify whether his bank has a maximum age limit or not.

Aside from the need to satisfy these criteria (a situation that includes many pre-retirement eligible workers), the other requirement is that evidence be presented that the individual has the wherewithal – even based in part on ongoing and prospective future income – to repay their obligations.

Application Process and Documentation Required

Application Steps

To apply for a loan against property

1. The applicant has to start by picking the application form from the bank of choice. It is important to submit this form along with the necessary Document list, just as if you were otherwise submitting it in person. Your application gets evaluated by the lender and the value of your property get assessed as per their internal rules.

2. On the subsequent page, they will enter all details whether related to the property being pledged. This can be ownership documents, any present open loans (if relevant), and additional details relevant to the camper/trailer.

3. Upon receipt of this information, the lending institution will execute a comprehensive review of the applicant’s capacity for eligibility as reflected by the details.

If all of these steps are done and your application passes their tests your application will be able to move to the approval in principal phase and if successful you will receive a formal offer to begin your property loan application.

Document Checklist

While applying for loan against property, there are few important documents which you need to provide. This will typically be evidence of identity i.

- Aadhar card or passport

- Proof of address (electricity or water bills, or rental agreement)

- Proof of income (in form of salary slips or income tax returns

- Bank statement reflecting regular transactions over a certain period

Documentation concerning ownership of the mortgaged property should also be provided. This includes but is not limited to land records, title deed and if there is any mortgage related papers.

Verification Process

Once you submit all required documents and apply for a LAP loan, banks start with an exhaustive verification process. That often involves checking the accuracy of all details supplied within both application forms and the records submitted with them.

The lender does intensive verification of credit history, legal status of mortgaged property, income proof submitted by applicants, etc.

Features and Advantages of Loan Against Property

Flexibility

One of the most important benefits of a loan against property is its flexibility. You can use the loan amount to expand your business, to fund education for your child, or meet any other financial need. Keeping with the previous example consider a property you own that is not generating any income; you can borrow against this property, and in turn, use the money to get that new business started or invest in one you know about.

Further, unlike certain loans such as home loans or car loans in which the usage is limited to the purchase of a home or a vehicle respectively, with a loan against property, you are free to use the borrowed amount on anything you please. This freedom is what makes it quite an appealing form of financing to those in need of a variety of funding options.

Lower Interest Rates

However, one of the biggest merits of taking a loan against property is pricing, as the interest rates charged on such credits are much lower than those on credit such as a personal loan or a credit card debt. This is due to lesser risk by nature of this loan as it asks for mortgaging of an asset which is immovable like property.

This is because lenders have a physical asset to reclaim if borrowers fail to make payments, which in turn allows them to offer lower interest rates than what would normally be assigned to unsecured loans. Thus, those in need for such large sums at reasonable rates of interest can find it an extremely helpful option for borrowing.

Analyzing Loan Against Property Interest Rates

| Bank | Interest Rate | Loan Amount | Tenure |

|---|---|---|---|

| State Bank of India | 10.60% p.a. – 11.30% p.a. | Up to 7.5 crore | 5-15 years |

| HDFC Bank | 8.95% p.a. – 10.25% p.a. | Up to 60% of the value of the property | Up to 15 years |

| IDFC First | 9.00% p.a. – 16.50% p.a. | Up to Rs.7 crore | Up to 20 years |

| Tata Capital | 10.10% p.a. onwards | Rs.5 lakh – Rs.5 crore | Up to 20 years |

| Axis Bank | 9.90% p.a. -10.35% p.a. | Rs.5 lakh – Rs.5 crore | Up to 20 years |

| Kotak Mahindra Bank | 9.15% p.a. onwards | Rs.10 lakh – Rs.5 crore | Up to 15 years |

| IIFL | 10.75% p.a. onwards | Up to Rs.10 crore | Up to 10 years |

| Edelweiss Financial Services Ltd | As per the terms and conditions | Up to Rs.25 crore | Up to 15 years |

| Bank of India | 11.25% p.a. onwards | Up to Rs.7.5 crore | Up to 15 years |

| L&T Housing Finance | 9.50% p.a. onwards | Rs.2 lakh onwards | Up to 18 years |

| Union Bank of India | 10.50% p.a. – 13.15% p.a. | Up to Rs.10 crore | Up to 15 years |

| Indian Bank | 10.00% p.a. – 12.60% p.a. | Up to Rs.5 crore | Up to 15 years |

| LIC Housing Finance | 9.50% p.a. – 11.55% p.a. | Up to Rs.7.5 crore | Up to 15 years |

| Bank of Maharashtra | 10.45% p.a. – 11.95% p.a. | Up to Rs.10 crore | Up to 10 years |

| PNB Housing Finance | 10.40% p.a. – 12.75% p.a. | Up to Rs.5 crore | Up to 10 years |

| ICICI Bank | 10.85% p.a. – 12.50% p.a. | Up to Rs.5 crore | Up to 15 years |

| Bajaj Housing Finance | 8.50% p.a. – 18.00% p.a. | Up to Rs.5 crore | Up to 30 years |

| UCO Bank | 10.95% p.a. – 12.10% p.a. | Up to Rs.5 crore | Up to 12 years |

| Indiabulls Housing Finance | 9.75% p.a. onwards | Based on customer’s profile, repayment capacity and the LTV ratio. | Up to 15 years |

| Bank of Baroda | 10.85% p.a. – 16.50% p.a. | Up to Rs.25 crore | Up to 15 years |

| Federal Bank | 12.60% p.a. onwards | Up to Rs.5 crore | Up to 15 year |

Fixed vs. Floating Rates

When lending money, two major choices for borrowers are fixed rates, and again – floating rates. Since a fixed rate keeps many of the borrower’s monthly payments the same for however many months and years the loan is spread out over, it gives a sense of stability. On the other hand, floating interest rates change with market fluctuations and can result in different monthly payouts for you.

For instance:

For those who value budget consistency, a fixed-rate loan is likely a better option.

On the other hand, if market conditions point to lower interest rates, you can benefit by taking out a floating-rate loan.

Borrowers must assess their financial situation and also can seek advice from financial advisors, on the type of interest rate they want for their loan against property.

Market Trends

Market dynamics: The movement of interest rates for loans against property is almost completely dependent on the market conditions. If certain economic indicators are indicative of inflation or recession, lenders may modify their lending practices appropriately.

For instance, during economic expansions and low inflation, lenders may offer lower interest rates to get more people to borrow. In contrast to this, Lenders may charge higher rates during economic downturns or high inflation times so to get protection from the possible risks in lending.

Comparison Tools

Decision-making becomes very user-friendly if you are looking to take a loan against property! You can take the route of specific comparison tools available which make you easily aware of different offerings from different lenders and make an informed choice. There are tools available that also assist a borrower in comparing loan offerings from different institutions based on multiple parameters — such as interest rates, tenor, processing fees, and more.

By utilizing these comparison tools:

This allows borrowers to find the terms that best fit their needs.

They may also do a good job at reducing the risk by selecting ones with favorable features like low costs overall or favorable repayment options.

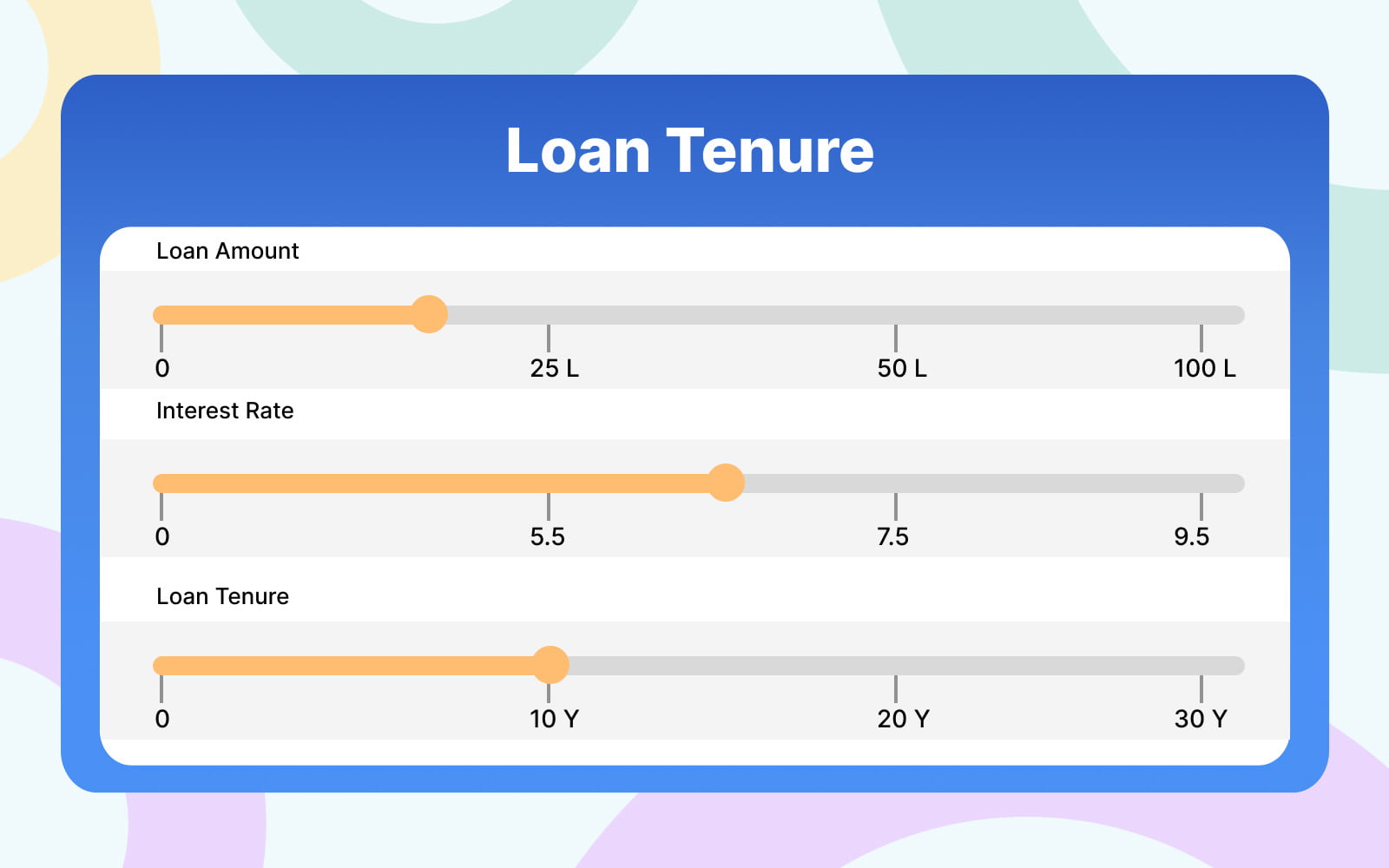

Choosing the Right Repayment Tenure for Your Loan

Financial Planning

While choosing the tenure of your Loan against property, you should also take into account your financial goals. If you plan to repay the loan in a short period of time, you may prefer to choose the lower tenure accepted. Another case, if you are one of those for whom lower monthly payments would suit better into his budget and has long financial goals, then you can go for an extended tenure.

EMI Calculation

When applying for Loan against property, it is important to understand the concept of calculating equated monthly installments (EMIs) with different repayment tenures to choose the right options. In general, less time you take, more EMI you pay and less is the total interest paid out. On the other hand, longer tenures would also give lesser EMIs, but higher interest cost over the entire tenure.

For example:

This would entail an EMI of roughly $955 for a $100,000 loan at an 8% rate over 15 years.

On a 20 year period, the same loan would produce an EMI close to $836.

You will need to weigh the difference between these figures and determine your financial condition, how much loan you are repaying and how far in the future, to finally decide which repayment period can be beneficial for you.

Prepayment Options

When considering a loan against property, check if the lender allows prepayment and the charges they levy on prepayment. Many lenders allow applicants to prepay all or part of their loan in full, with no penalties. The upside of this flexibility is that it can help borrowers to reduce their outstanding principal, and thus interest costs, over time.

Yet, some lenders may charge prepayment penalties or pre-closure charges for pre-closing the loan or making large prepayments exceeding the specified limit in an year. That’s why it is very important for evaluating about the terms and conditions regarding the early payment facility of the loan before put a step further in the contract with the particular lender.

Tax Benefits Associated with Loan Against Property

Deductions Available

Interest payment carries tax benefits. As a result, the tax-exempt amount decreases when the interest paid upon the loan can be extracted from the total income. The deduction is allowed under Section 24 of the Income Tax Act which results in a considerable tax saving.

So, if I take a loan against my property for renovating my home or for expanding my business, I can deduct the interest paid on the above. This provides tremendous benefit as the total tax outgo reduces and disposable income increases.

End Use Restrictions

The tax benefits of a doemnstic loan against property: This tax benefit can change if the proceeds are used to make an investment. For example, if the borrowed amount goes to home improvement or business development, more significant deductions may apply. But if it is used for any personal use such as for marriage expenses or for funding a trip, it might have restrictions on tax benefits.

For instance, the person who has taken aloan on his property to get his child’s educationor medicine could receive a tax deduction but it will be less favorable than using it to build or remodel a home.

Comparing loans against Property and Personal Loans

Collateral Requirement

A loan against property is a credit which is offered to the borrower by the bank or any financial institution by keeping the property as a guarantee (This can be a residential property or commercial property). Personal loans, in comparison, are unsecured. This implies that when an individual is unable to repay a loan against property, the lender is allowed to take over the property mortgaged.

One example, if someone uses their house to own “loan” essentially using their home as a security for the loan. In the case of personal loan, individuals can borrow money without any security being asked against the borrowed sum.

Unlock the potential of your property with a loan tailored to your needs. Explore your options for home loans in Coimbatore today and take the first step towards financial flexibility.

Selecting the Ideal Lender for Your Needs

Reputation and Credibility

So when it comes to selecting a lender for Loan against property, make sure you choose a lender who has a good market repo, support system, and reliability. Find lenders who have a history of helping their customers successfully Read online reviews or ask for recommendations from people you trust who have used the lender to get a sense of the lender’s integrity. It gives comfort to borrowers to know that they are dealing with an honest institution.

The reputation of potential lenders

Customer service quality

Reliability of lenders

Processing Timeframes

When seeking for loans against property you should compare processing times offered by different lenders. Quicker processing times would potentially lead to distensions into urgently required funds in emergency situations. Certian lenders are going to have efficient process that enable them to rapidly accept and distribute fund that there loan competitors may not offer.

Comparison between processing times

Quick approval and disbursement timelines

The Importance of Quick Funds Access

Additional Services Offered

Certain organisations also give other services or benefits that will make it a better experience to borrow from them apart from lending against property. These will be in the form of easy to access online account management platforms, insurance products that are specific to loan products, and other value-added services that are focused on servicing the borrower throughout their tenure with that loan.

Self-managed account online

Tailored insurance options

Lender-Based Value Add

Summary

To help you arrive at an informed decision when it comes to a loan against property, we have elaborated on these aspects. Editors: If republishing, please attribute this story to KHN and note that it was originally published on khn. Informed decisions can result in more favourable financial outcomes and ensure that loan against property benefits are utilized to the fullest.

Frequently Asked Questions

What are the eligibility criteria for availing a loan against property?

In order to take a loan against property, the person usually has to be between 25-70 years, has to have clear titles of property and has to have a regular source of income. Most people who pledge a property for pledge loans promise to pay back the loan, with the eventual goal of selling the property in order to do so, although other factors are also taken into consideration by lenders, such as whether the property will sell for enough on the open market to finance the loan’s interest and the loan amount itself, and also the previous credit history of the pledgor.

How does one apply for a loan against property and what documentation is required?

Loan against property application form plus necessary documents to be submitted- Identity proof, address proof, income statement & property related documents Documentation: The Lender May Ask for Your Documents (For any specific requirements)

What are some features and advantages of taking a loan against property?

Due to the unsecured nature, Loan against Property come at lower interest rate than personal loans. These lend substantial funds against the value of the mortgage asset. It offers varied repayment periods, lets borrowers choose from different repayment tenures.

What tax benefits are associated with taking a loan against property?

If you take a loan against your properties, interest paid can bring tax benefits subject to some conditions. You will get Income Tax Benefits:- Home loans are secured in nature hence individuals can deduct interest payments from income under Section 24(b) and processing fees/prepayment charges can be deducted under section 37(1).

How do you compare loans against property interest rates from different lenders?

When one compares interest rates, the analysis extends from fixed or floating rates on offer by.