Introduction

From consolidating debt to paying for home improvements, personal loans are one of the more popular ways that people can secure needed funds. These vehicle loan products are flexible, allowing them to be adjusted based on certain financial circumstances. Through this blog you can know what personal loans are, what to keep in mind while you checking out your options and how a loan agency can ease the process for you and at the same time make it an efficient process.

Understanding Personal Loans

A personal loan is one kind of installment loan where borrowers can use the money they receive as a lump sum and repay it in a set amount each month with interest. These loans are usually unsecured, meaning they’re not guaranteed by ANY collateral (like a house, or car, etc.).

This is why, lenders rely so much on the credit of the borrower and his/her ability to pay to decide whether he is eligible for this loan and on what terms.

When exploring personal loan options, having expert guidance can make all the difference. Discover how you can secure the best personal loan in Coimbatore with the help of our experienced loan agency.

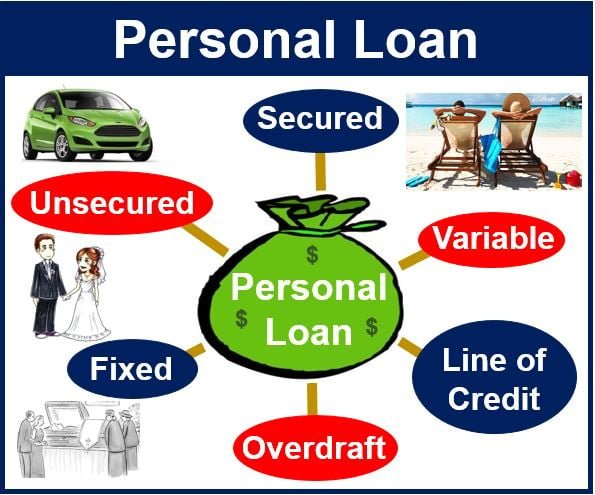

Types of Personal Loans

Personal loans are broadly categorized as secured and unsecured loans.

- Secured Loans: A secured loan is backed by assets like a savings account or a piece of property. With a secured loan, the lender has the threatened of taking an asset if the loan is not repaid; therefore, these types of loans usually carry lower interest rates. However, this is risky- if the borrower fails, the lender can often take the collateral.

- Unsecured Loans: These are personal loans; most personal loans fall in this category. And they do not require a guarantee, but typically have higher interest than secured loans. Approval and rates are primarily based on the borrower’s credit score and financial history.

Key Features of Personal Loans

- Fixed vs. Variable Interest Rates:

- Fixed Interest Rates: The rate does not change for the life of the loan, which means your payment amount will remain constant. Therefore, it gives the borrower more stability, which in turn makes budgeting for a loan easier.

- Variable Interest Rates: Market conditions may cause these to change. Although they might start out lower than fixed rates, they can go up over time, meaning you could face higher monthly payments and overall loan costs.

- Loan Amount:

- The amount you can actually borrow can vary a lot based on the lender and how qualified you are.

- Repayment Terms:

- Personal loans usually come with terms that last between 12 months, or one year, to 84 months, or seven years. A longer-term reduces the monthly payment amount but increases as a whole the interest paid over the life of the loan.

- Interest Rates and APR (Annual Percentage Rate):

- This takes into account the interest rate, plus the actual cost (or fees) that the lender is charging, and provides a more complete understanding of the cost of the loan. Interest rates often differ enormously based on the borrower referring to score, with an average around 6% for great credit while as much as 35% for bad credit.

Common Uses of Personal Loans

- Debt Consolidation: A way to reorganize multiple debts to one new loan at a lower interest rate, with a single monthly payment.

- Home Improvements: To fund a home project or repair

- Major Purchases: Pay for large expenses such as wedding, holiday or hospital bills expenses.

- Emergency Expenses: Responding to unexpected costs like vehicle repairs or immediate health check-ups.

Approval Process

- Application: Application Borrowers complete an application, providing their financial information and how much money they would like to borrow.

- Review: A review of the application- they look at your credit score, income, and debt to income ratio.

- Approval: If approved, the borrower signs a loan agreement with the terms

- Funding: Once the deal is made the funds are usually transferred as the full sum of money to the borrower’s bank account (loan).

Loan Terms and Conditions

- Monthly Payments: What you pay on a monthly basis: Monthly Payments Fixed or variable amounts paid monthly over the course of the loan.

- Origination Fees: Charged by some lenders to process a loan and expressed as a percentage of the loan amount.

- Prepayment Penalties: If you pay off your loan early, you might have to pay a fee in the form of a prepayment penalty to your lender for the lost interest.

Factors to Consider When Evaluating Personal Loans

Here is how to evaluate personal loans to select the best personal loan according to your financial needs. We will explore these aspects in-depth in the following points:

Interest Rates

- Fixed vs. Variable Rates:

- Fixed Rates: Fixed interest rates never vary over the life of your debenture, which can make it easier to plan on what you owe on a monthly basis. Budgeting also becomes easier with this kind of stability in a monthly payment amount.

- Variable Rates: Interest rates on an adjustable rate may move higher or lower as market interest rates change. Although these rates can probably qualify you for a lower starting point than a fixed rate would, if and when these rates go up, your monthly payment and cost over the life of the loan will rise.

Fees and Charges

Origination Fees: This is charges levied by the lenders for the processing of the loan. This fee usually constitutes a small percentage of the loan amount, ranging from 1% to 10% of the loan amount. Many lenders will take this fee out of the loan proceeds, and some will include it in the loan balance, effectively increasing the total loan cost.

Application Fees: This is the fee that is charged by some lenders for processing the loan application. This fee is generally non-refundable, even if your application is rejected.

Late Payment Fees: Missing a payment means you may be charged an additional fee being a set dollar amount (ie $15) or a % of the missed payment.

Prepayment Penalties: if you pay off your loan early, some lenders will issue a penalty since they lose the interest on the loan. Find out if your loan has this penalty its perquisite so that you can fully comprehend how it is.

Loan Amount and Terms

Loan Amount: The amount you can borrow depends on the lender and your creditworthiness. Personal loans typically have an amount you can borrow of $1,000 on the low end and $100,000 on the high end. Remember, only borrow what you need to stay out of debt.

Repayment Terms: Personal loans have an overall repayment period of around 12-84 months. Term Lengths: Longer terms lower a month-to-month payment, however increase total money paid on loan over the life of the lending.

Credit Score Requirements

- Impact on Approval and Terms: Credit score has a major impact on whether or not you qualify for a personal loan, and the rates you will be offered. Credit scores are divided by the lenders in forms as:

- Excellent (720 and higher)

- Good (690-719)

- Fair (630-689)

- Poor (below 630) Higher credit scores generally lead to lower interest rates and more favourable loan terms. Individuals with lower scores may be charged higher interest rates and be subjected to more stringent terms

Annual Percentage Rate (APR)

- Comprehensive Cost of Borrowing: The APR is the interest rate plus any lender fees, making it the true cost of the loan over a year. Compare APRs to find the lowest cost option.

Loan Purpose

- Intended Use: Purpose of Borrowing Some lenders offer different rates and terms depending on what the loan is being used for. For example, debt consolidation loans might have lower rates than loans for vacation or other discretionary spending. This can save you a lot of time spent on comparing loans with better terms with the help of loan comparing websites.

Flexibility and Additional Features

Repayment Options: Find a lender who provides an interest benefit with the possibility of bi-weekly payments If your loan goes into default or into delinquency, some lenders can offer deferment or forbearance in times of financial hardship.

Customer Support and Resources: Lastly, examine customer support, other resources (like financial education, budget tools, etc.) Quality customer service: If you run into trouble or have questions about your loan

Comparing Lenders

- Types of Lenders: Various lenders, traditional banks, credit unions, online lenders, and peer-to-peer platforms, all have their advantages and disadvantages; Determine between them by type of interest rates, the approval process, and customer service.

- Prequalification Process: Most lenders allow you to prequalify for a personal loan to see estimated rates and terms without affecting your credit score. So, you can compare the multiple quotations from multiple lenders before you take the decision.

Role of a Loan Agency

A loan agency has a key function to assist individuals in navigating their way through the tricky and often quite confusing personal loan landscape. Get a closer look as to how an the loan agency can help the borrowers by going through the major pointers below.

Expert Guidance

- Navigating Options: With the range of alternative personal loans, loan agencies help to navigate the best personalloan. They break down the various aspects of fixed rate vs. variable rates, secured vs. unsecured loans, and what terms can and did not imply

- Understanding Terms and Conditions: Clarification of the fine print of the loan agreement so that the borrower knows all the conditions issued. This means understanding fees, penalties, and terms.

Comparison Shopping

- Access to Multiple Lenders: They have established relationships with a large number of different lenders, which affords them with the ability to offer a selection of loan products This lends itself to compare various offers from several lenders to find the best rates and terms for the borrower.

- Tailored Recommendations: Loan companies can suggest the most effective loan items depending on the borrower’s financial health insurance and requirements. This tailored approach provides borrowers with loans that suit their financial goals and repayment capabilities.

Application Assistance

- Streamlining the Process: Loan agencies help simplify the application process by walking borrowers through the steps and making sure all correct and complete documentation is submitted. This minimises errors and delays.

- Document Preparation: The agencies help you in flagging and preparing the documents like income statements, credit reports and identification. This step makes sure your application is good to go and everything checks out with the lender.

Negotiation and Advocacy

- Better Loan Terms: Lenders may be more accepting of your proposal if you are backed by a loan company that can negotiate your place to a better interest rate, less fees, or even easier payback plans.

- Resolving Issues: Should problems arise such as inaccuracies in the borrower’s credit file that need to be cleaned up, or if in underwriting, things are going sideways, loan agencies can provide representation and remediation guidance to keep the process moving smoothly.

Benefits of Using a Loan Agency

Loan agency has multiple benefits especially for those who apply for personal loan. These advantages can go a long way to improve the borrowing experience, making it easier for borrowers to get the perfect loan that fits their needs. So, here is a detailed perspective on the benefits from the same.

Time-Saving

- Efficient Process: The loan application process inevitably involves quite a bit of paperwork, and loan agencies ensure the process is as efficient and quick as possible. This involves collecting the required documents, filling in application forms, and corresponding with lenders on the part of the borrower. This has made the life of the borrowers so much easier which in turn saves a lot of time and efforts of the borrowers.

- Quick Comparisons: Borrowers no longer need to personally research and contact several lenders in search of the best deal, as the loan agency compares loan offers from different sources quickly for them. Borrowers are able to find the best loan options for them quickly without having to do it themselves.

Better Loan Terms

- Access to Multiple Lenders: Lenders maintain relationships with many other lending agencies. This right allows them to shop around for multiple loans on behalf of their borrowers, meaning that they can offer both reduced rates and more lucrative terms such as increased repay periods as well as other benefits.

- Negotiation Power: Professional loan agents can negotiate with the offered lenders to get better loan terms on behalf of the borrower. This could involve negotiating for lower interest rates, fee waivers or improved repayment terms.

Personalised Service

- Tailored Advice: Loan agencies give you customized advice which vary depending on financial situation and it ongoing needs. They evaluate the credit profile, income, and loan needs of the borrower to come up with the best loan options.

- Support Throughout the Process: From the very first consultation to the ultimate loan approval, loan agencies ensure that customers are offered support at every step. They assist the borrower step by step in helping the latter comprehend every terms and conditions and to educate them with the decisions they are about to make.

Expertise and Guidance

- In-Depth Knowledge: Loan officers know a lot about the lending market, this includes current trends, rates, and products. They use all this knowledge to offer recommendations and insights that a single borrower might not have on his or her own.

- Credit Improvement Tips: Agencies may also be able to give you advice on improving your credit score before you apply for a loan. Better loan offers are available with higher credit scores, and loan agents can recommend steps borrowers can take to improve their credit profiles.

Reduction of Stress and Hassle

- Handling Complications: Loan agencies lend a hand to solve any problems that might emerge while the borrower applies for a loan, such as an error in the borrower’s credit report or any issues with the accompanying documentation. Dealing with such complications would be easier for the borrower because they have done this process for so long.

- Simplifying Complex Processes: Simplifying Complex Processes The loan application process is quite complex and intimidating, especially for new borrowers. The loan agencies have simplified this by breaking the complex technical terms and procedure to simple steps making the borrowing experience less troublesome.

Navigating personal loan options can be overwhelming, but our loan agency is here to assist. If you’re also looking to expand your business, explore the best business loan in Coimbatore with our expert guidance.

Increased Approval Chances

- Optimised Applications: Loan ap -optimised applications Lenders need to follow specific stipulations and applications They also help in improving the chances of loan approval by means of provision of all the required information and documentation in a correct manner.

- Prequalification Assistance: Agencies can also help you in the process of prequalification, where you are able to see what kind of rates and terms you might be looking at without it having any effect on your credit score. This will guide borrowers into the most lucrative loan deals before they pour in a full application.

Conclusion

It can be tough to figure out what to do with your personal loan Graphic: GFM Network/UnsplashChoosing the right personal loan can be challenging difficultWhat you need to know.getKey personal loan factors to consider Best.

You will be better equipped to make an informed decision by understanding how interest rates, fees, loan amounts, terms and your credit score play into this decision. In this, loan agencies act as a main catalyst as they provide expert advice, compare loan options, help with applications and negotiate for better terms. A loan agency can save you time, make the process less stressful, and even improve your likelihood of being able to borrow the best loan for you.