Understanding Different Types of Business Loans

Specific Financial Needs

There are various types of business loans that focus on different financial requirements. However, if another company has a need for working capital to handle day-to-day cash flow issues, it may find a line of credit more appropriate.

Many times businesses need funds for different reasons including growth, stock management or even for a new business startup. Fortunately, there is a wide range of business loans available to fulfil each of these requirements.

Crucial Decision-Making

Knowing the business loan types can make a difference in the decisions a business man reaches on whether to go for startup loans, or opt for unsecured start up loan pack. As a business owner or entrepreneur, it is important that you understand the different types of loans that are available so you can determine which type of loan is best in keeping with your financial goals and your financial state.

In understanding their near term requirements for a loan, businesses are able to make qualified decisions on how much debt they should borrow and what kind of debt will serve the business best as a part of their long term goals.

Are you searching for a good financial solution in order to expand your business? Find out best small business loans in Coimbatore and let your business grow.

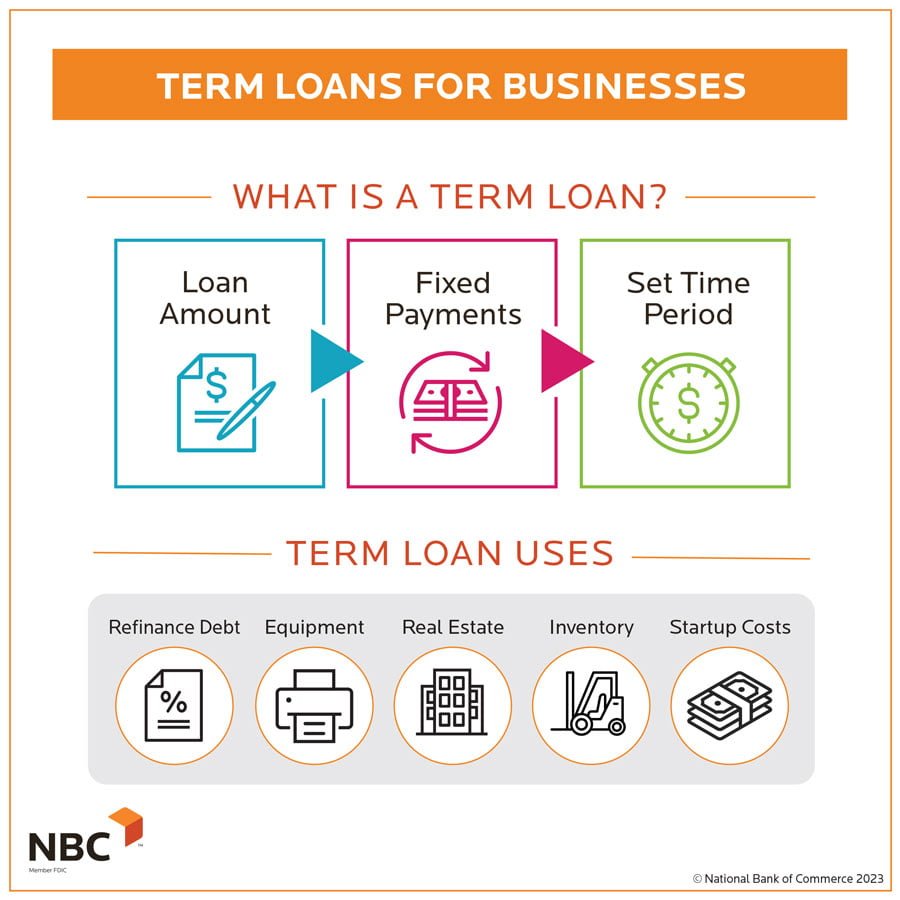

Overview of Term Loans for Businesses

Fixed Repayment Schedule

Term loans are a type of business loan that offer the borrower a lump sum amount with fixed repayment terms. This means the borrower is given a limited amount and is required to cover back in regular schedules over a period of time.

Term loans are excellent for long-term investments or other big business expenditures because they give you a lump sum of capital in one go. With this type of funding, companies can chase growth opportunities, buy equipment, or even purchase another business.

Interest Rates and Repayment Periods

Interest rates and repayment periods can vary when thinking about term loans as a loan offer.

These terms are generally decided by the lenders based on how creditworthy they find the borrowing business to be. Lower interest rates and more advantageous repayment conditions may be applied if the financial history and repayment history are good.

Working Capital Loans Explained

Purpose of Working Capital Loans

Working capital loans are meant to give business breathing room from the day to day obligations. They are the loans you need just to tide over cash flow discrepancies and meet urgent financial commitments.

Businesses often find themselves in situations where they need quick capital to continue their business operations without having to slam the doors shut for the day. This is when working capital loans come in handy in making sure companies can avail the necessary funds to meet unforeseen expenses or temporary revenue lulls.

Assessment Process by Lenders

Lenders traditionally look at a business’s short-term balance sheet when considering applications for working capital loans. This test helps the company assess whether it has sufficient short term liquid assets that are cash equivalent that can be used by the company to payoff its near term obligation or pay cash without impacting the business cycle. Other areas such as the credit history of the business and the revenue trends will be analyzed by the lenders to understand the business loan repayment capability in a specific period.

The assessment helps ascertain a round-up of the company’s financial position, focusing mainly on accounts receivables, inventory, payables, and cash.

Invoice Financing and Factoring for Cash Flow Management

Understanding Invoice Financing

Invoice financing, also known as accounts receivable or factoring financing, is a way for businesses to borrow money from outstanding invoices that are owed to them. Rather than waiting for customers to pay, a business can actually sell its unpaid invoices to a financial institution or a funding facility, at a discount.

These are particularly useful for businesses that have long payment terms or encounter seasonal peaks.

Keep in mind that invoice financing is not a typical loan; while traditional loans depend on credit history, mortgage brokers, and collateral, invoice financing uses the value of your unpaid invoices as collateral. This option may be more accessible for companies that do not have a well-established history of credit.

Exploring Factoring as a Cash Flow Solution

Factoring is the sale of accounts receivables at a discount in exchange for cash immediately. The company acquires the outstanding accounts receivable of the business and pays up-front 80-90% of the total amount. The factoring company then releases this balance (less fees) to the business once the invoice is paid by their customer.

Factoring also offers the well-known advantage that business owners can convert future revenue expectations into cash flow today, without going more in debt. This also keeps companies from running into any trouble due to customers who may delay pay and still keeps the businesses on track with great growth opportunities.

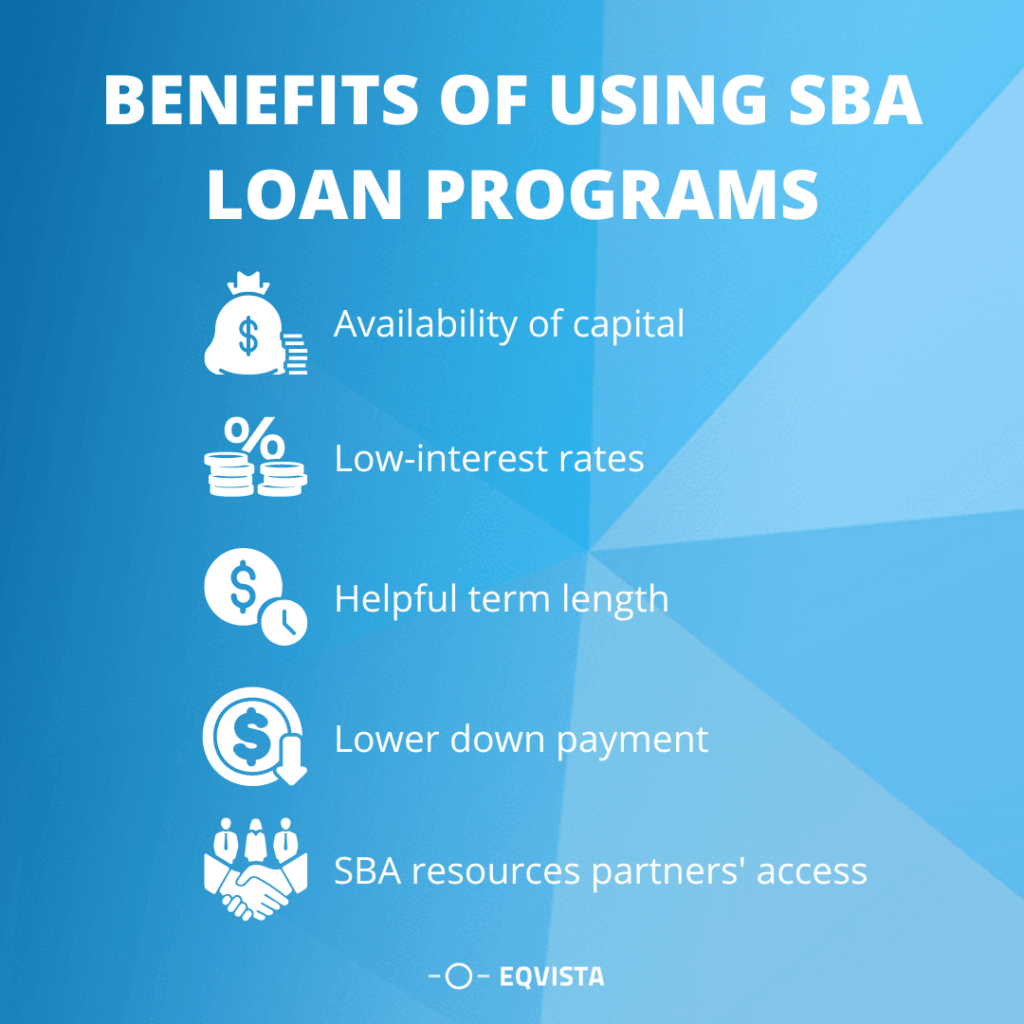

Unveiling SBA Loans and Their Benefits

Ideal for Startups

SBA loans, as an example of a secured loan backed by the Small Business Administration, bargain better terms and lowered money down needs. Best for startups, small business and entrepreneurs who have issues securing a bank loan All of these loans are meant to give that extra financial push a person needs whenever they are just getting put in place with a new things.

Longer Repayment Terms

Longer Repayment Terms: SBA loans provide some of the longest repayment terms in the business lending world. This function permits the borrower to distribute their repayment for an extended term hence offering the debtor an alternative to face less hefty monthly expenses.

Competitive Interest Rates

Since SBA loans boast competitive interest rates, they’re quite appealing as a means of keeping borrowing costs down while still securing important funding assistance for the businesses who use them. These lower interest rates reduce the cost of borrowing money now, which in turn can play a big part in saving the business owner or entrepreneur money over time.

Merchant Cash Advances and Microloans for Small Businesses

Quick Access to Funds

Merchant Cash Advances give quick access to advance based on future credit card sales. This allows small businesses to quickly obtain the capital required without being subject to a lengthy approval process. After all, a small business that needs cash immediately to buy stock or cover a bill due now is a small business with the right situation to benefit from merchant cash advance financing.

Microloans also provide quick access to the cash. This would be the one that is tailored to the needs of small businesses and start-ups.

Microloans help entrepreneurs to purchase new equipment, hire more staff or enhance their marketing efforts so they can meet their financial needs promptly without any delay.

Flexibility and Faster Approval Processes

Both merchant cash advances and microloans are much less regimented than traditional bank loans and getting your hands on needed funds for operations is a breeze. These let borrowers have more liberty to use the borrowed money for different applications with respect to the development of their businesses.

Merchant cash advances from online lenders have less demanding qualifications than loans from traditional lenders. This simplifies the process of qualifying for this type of financing for newer entities or businesses with less prominent credit histories (women entrepreneurs, for example).

In the same vein, generally, microloans are also less formal than loans issued by conventional financial institutions like banks. The documentation for these loans is typically less and the time it takes to receive a decision by the lenders that cater to small business is quicker.

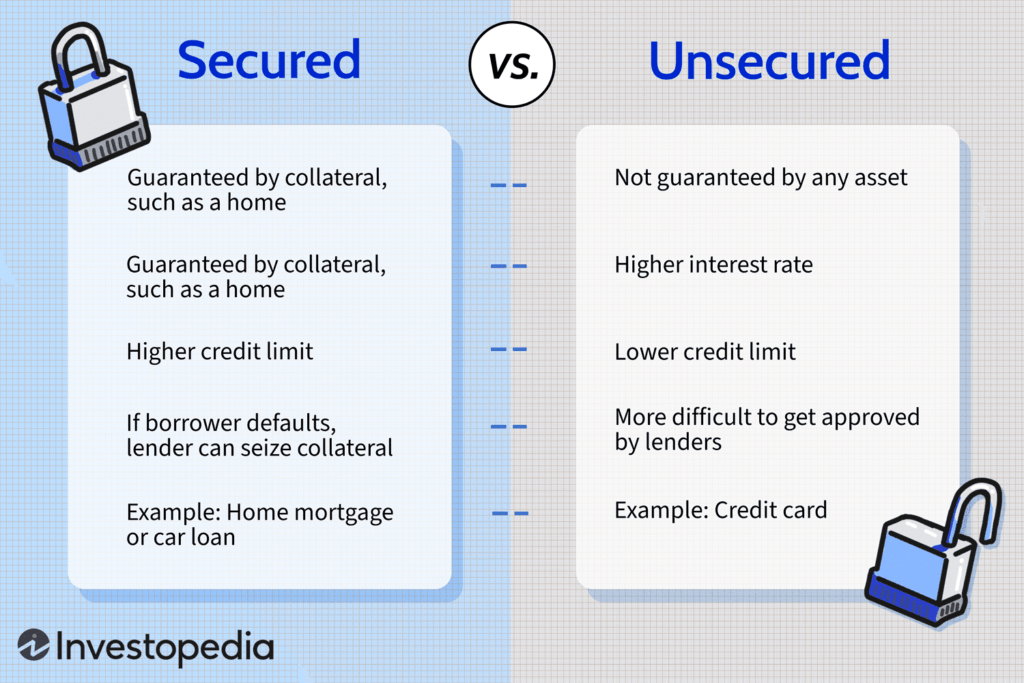

Unsecured vs. Secured Business Loans

Collateral Requirements

1. Typically, secured business loans demand collateral in the form of property or equipment to secure the amount of the business loan.

2. Unsecured Business Loans- No Collateral Lenders do not rely on assets as collateral but instead evaluate credit scores and other financial information to determine eligibility and terms of the loan.

Risk and Interest Rates

1. When loans are backed up by collateral, they are lower risk for lenders, and will offer lower interest rates. These are secured debts, so if the borrower defaults, the lender has some recourse to recoup its money.

2. With unsecured business loans, they often work out to be a little pricier as lenders need to make the product more attractive given the absence of any quick security. That means more risk for the lender, who has to compensate for that increased risk with higher rates.

Considerations for Borrowers

Borrowers should weigh their own assets and risk tolerance when choosing between secured and unsecured options. However, individuals that have significant assets but poor credit hoping to qualify for a loan may have an easier time with secured loans rather than unsecured loans.

Since those with good credit are likely to qualify for each kind of loan, they are not as constrained as bad credit borrowers in choosing between a secured or unsecured option. Nonetheless, they need to balance the scales between the benefits of lower interest rates with the dangers of giving personal guarantees or having to put at risk valuable assets as collateral.

Commercial Real Estate and Equipment Financing

Tailored Solutions

1. Commercial real estate financing is a way for businesses to buy property for expansion or operations. Commercial Real Estate LoansThis is the type of business loan that you need in order to generate money to buy land, buildings, or additional real estate asset.

2. By contrast, commercial equipment financing allows businesses to purchase machinery, vehicles, or technology without exorbitant upfront costs.

3. Both financing types provide a custom product designed to suit the individual requirements of that specific asset acquisition.

4. In order to up expand your business you will need extra space or premises. For commercial real estate financing, they can borrow money to buy new office spaces, warehouses, retail stores, or production plants.

For instance:

A growing logistics company could utilize commercial real estate financing to purchase a larger warehouse facility.

An expand-chain in retail can use this funding to buy new locations in the right demographic areas.

Asset Acquisition

For accessing various tools and resources that are essential for daily operations of a business, you just need Equipment financing. It is for construction companies to heavy machinery or for IT forms to advance technology with this finance form allows businesses penetrating and getting the required assets without using up more cash reserves.

For example:

A construction company might use equipment financing as a means to buy bulldozers and excavators.

An IT services provider might opt for this funding option when acquiring servers and networking infrastructure.

Summary

In reality, there is so much more business owners need to understand about the varying types of business loans available to them. Each serves a significantly different purpose and comes with separate sets of benefits and considerations – from term loans and working capital loans to invoice financing, SBA loans, and merchant cash advances. Regardless of whether your business needs funds to grow, manage cash flow or for equipment financing, Grow Associates is the ideal choice for a business loan in Coimbatore Region. Contact Us For More Information.

Frequently Asked Questions

What are the different types of business loans available?

Biz2Credit provides all kinds of business loans – term loans, working capital loans, invoice financing, SBA loans, merchant cash advances, microloans, unsecured business loans, and secured business loans, as well as commercial real estate and equipment financing.

How can a small business apply for a loan in India?

A small business in India would normally have to submit documentation, including financial statements, tax returns and business plan details, along with the necessary collateral documentation in order to apply for a loan. They will then apply through banks or any financial institution.

What is the difference between unsecured and secured business loans?

Business Loan with Securities: This type of business loan requires you to secure an asset that you own, generally real estate or equipment used in the conduct of your business. Unsecured business loansOn the other hand, these loans do not need any guarantee, and this increases the risk, this risk may cost you a high interest rate on the loan.

What is invoice financing and factoring for cash flow management?

Invoice Financing: Here you use the unpaid bills from your customers as collateral to secure a loan. Factoring is like an easier loan except you are getting cash as soon as the invoices are paid.

Can you explain SBA (Small Business Administration) Loans and their benefits?

An SBA loan is a government-backed loan that is offered by the Small Business Administration to help small businesses obtain financing with lower borrowing costs. This usually includes reduced down payments, longer repayment terms, and a more lenient qualification process than you may get compared to traditional loans.