Understanding the Basics of Personal Loans

Unsecured Nature

Personal loans are commonly used for household purposes such as funding small renovations, buying furniture, groceries, travel or accommodation, private medical, government helath services, boating, furniture, bicycling or exercise, anything from after A levels decoation,… Personal loans-unlike a mortgage or an auto loan-do not require collateral. This, in turn, requires no collateral which are assets from the borrowers side to be kept on hold such as Home, Car, etc. as security for the loan.

This unsecured nature of personal loans also makes these loans available for people like tenants; who have no valuable asset to offer as security.

Borrowing and Repayment

That is when an individual borrows a set amount of money from a lender, see personal loans. It ranges from a few hundred dollars to tens of thousands of dollars depending on the lender and the borrower’s creditworthiness.

The borrowed sum is then repaid in full via regular payments. Those installments are usually a combination of the principal borrowed and the interest accrued. This amount has to be repaid over a predefined period of time which usually lasts for several months and sometimes years which is decided at the time of taking the loan.

Ready to take control of your finances? Explore our personalized personal loan in Coimbatore tailored to your needs. Secure the funding you need to accomplish your goals and achieve financial freedom today!

Terms, Conditions, and Responsibilities

This includes being aware of,

- Possible fees like origination fees (that some lenders charge when you establish your loan)

- Prepayment penalties (the fees lenders will charge you for paying off your loan early)

- Late payment charges (if you miss making payments on time)

Moreover, in order to prevent impacting ones credit score or causing more harm to ones credit profile by defaulting on the loan, as a responsible borrower one needs to understand the importance of making timely repayments.

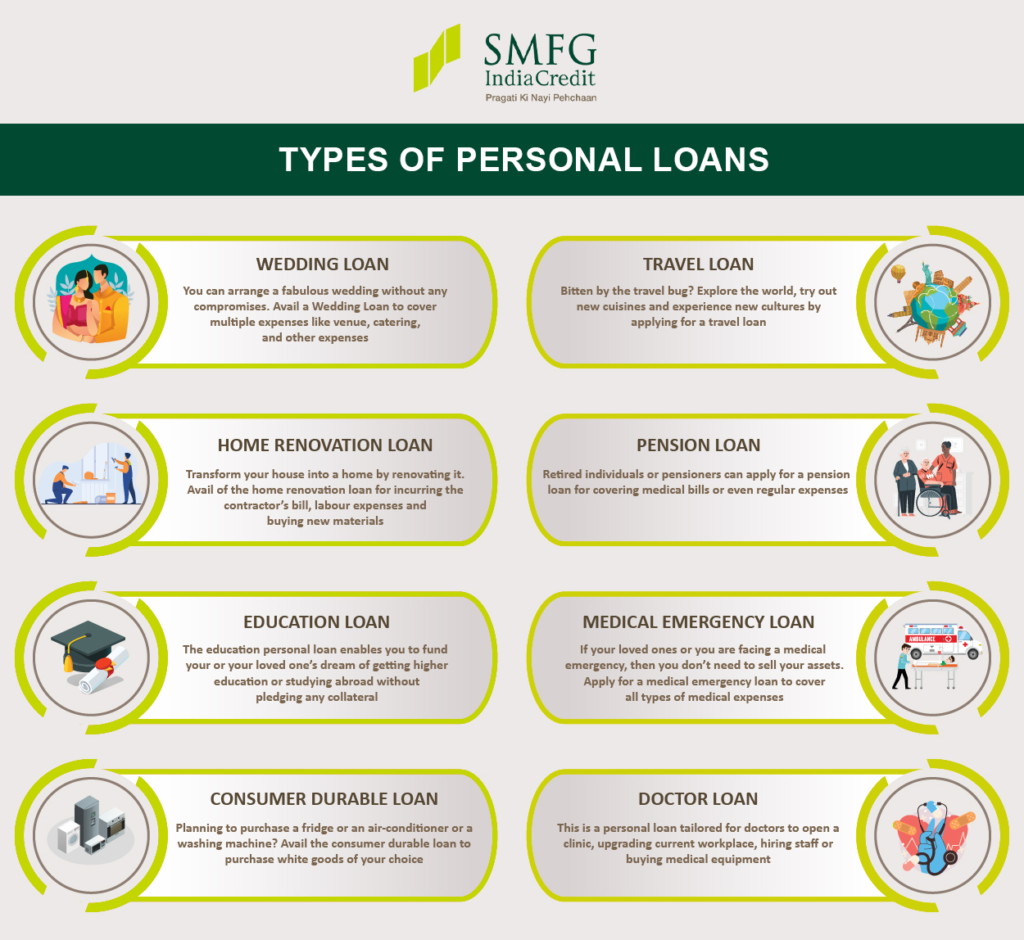

Types of Personal Loans Available

Secured and Unsecured

1. There are two types of personal loans such as secured loan and unsecured loan. Secured Loans- These require collateral, like a car or a savings account to support the loan. In case of a default on payment, the lender can take over the collateral.

2. Conversely, an unsecured personal loan may not be secured by any collateral, whereas this can lead to an increase in interest rates because the lender is taking greater risk.

For example:

If you have a big purchase or a project coming up, but you have the available assets to put up against a secured personal loan, it may be an option to get a larger sum of money.

Unsecured personal loans are great for people who do not want to risk their assets, but are willing to pay a higher interest rates.

Fixed-Rate and Variable-Rate Loans

The latter are broken down into two groups:

- fixed-rate and: he interest rate remains constant throughout the entire term of the loan

- variable-rate loans: Variable-rate-Borrower pays interest based on a benchmark index fluctuating this rates

For instance:

Fixed-Rate Personal Loans For those who prefer knowing exactly what their monthly payments will be

Borrowers who may not mind monthly payments that could change can opt for a variable-rate personal loan.

Specialized Loans

Other lenders offer personal loans in the form of a debt consolidation loan or an unsecured loan for home improvement projects. Debt consolidation loans are a way that borrowers can roll multiple debts into one new loan with better terms, while home improvement loans are specifically for work done on your home.

Considerations:

One of the most common financial challenges for individuals is balancing multiple high-interest debts, and consolidating these high-interest debts into a single low-interest personal loan can make the repayment of these debts much simpler.

Homeowners renovating their home may also find that specialized home improvement loans provide better terms than other types of personal loans.

Eligibility and Application Requirements for Personal Loans

Understanding Eligibility Criteria

Lenders typically consider factors such as,

- Credit score

- Income

- Employment history

These are essential conditions you need to meet: This is a mandatory aspect that you must satisfy to get an approval in the loan application. For example, a person who has a low credit score or isn’t able to prove that he or she can pay back a loan on time is someone a personal loan lender is going to have a tougher time lending to than a person with a high credit score and proof of income.

Necessary Documents for Application

When filling a loan application, applicants are normally expected to bring in some of the documents. These files may contain,

- Proof of identity (ID)

- Proof of address (e.g. utility bills or lease agreements)

- Earnings statements (e.g., pay stubs or tax returns)

Applications form is also supported with these documents, so these documents are the prove the information that you have provided in application form.

Benefits and Features of Personal Loans

Flexibility in Usage

You can use Personal Loans for anything that combine a variety of needs. From consolidating debt, to covering unexpected medical expenses, to making a large purchase, personal loans can be a solution for many different financial problems.

One such use of personal loans is in home improvement, wedding/vacation, educational purposes etc. The flexibility and versatility in usage empower borrowers to fulfil their distinct financial needs without any restriction or control over spent of funds. For instance:

If you have some high-interest credit card debt, consolidate this into a much lower monthly payment.

Upgrading your home without using your savings.

Competitive Interest Rates and Fixed Monthly Payments

A key advantage to using personal loans is that they typically come with low interest rates. Personal loan interest rates are generally lower than those of credit cards and payday loans, which means borrowers can save money in interest charges in the long run.

When your repayments are the same amount each month it makes it easier for you to manage the budget and plan your finances with certainty. For example:

The predictability provided by fixed monthly payments enables individuals to budget effectively and plan their finances with confidence. For example:

Borrowers can expect regular monthly payment amounts.

Protect themselves from interest rate fluctuations and surprises

Quick Approval Processes

One more key benefit of personal loan is that they come with rapid approval mechanism. As for many of the lenders that offer such solutions, the goal of a personal loan is to quickly provide you with a decision so you can access financial help right when you need it the most. Unlike other types of finance that may require a huge amount of paperwork and long approval terms, this kind of finance is used to provide you with the money you need in the shortest time possible in case of financial emergencies.

With unpredictable needs such as sudden medical bills or car repairs, this turn-around time is essential.

A few lenders will even approve applications in as little as two hours.

You can be funded as fast as the next business day after approval.

Interest Rates, Fees, and Loan Tenure

| Bank | Interest Rate (p.a.) | Processing Fee |

| HDFC Bank | 10.5% p.a. – 24.00% p.a. | Up to 2.50% |

| ICICI Bank | 10.50% p.a. – 16.00% p.a. | Up to 2.50% |

| TurboLoan Powered by Chola | 14% p.a. | 4% – 6% |

| Yes Bank | 10.99% p.a. onwards – 20% p.a. | Up to 2% |

| Kotak Mahindra Bank | 10.99% and above | Up to 3% |

| Axis Bank | 10.49% p.a.- 22% p.a. | Up to 2% of the loan amount |

| IndusInd Bank | 10.25% p.a. – 26% p.a. | 3% onwards |

| HSBC Bank | 9.99% p.a. – 16.00% p.a. | Up to 2% |

| IDFC First Bank | 10.49% p.a. onwards | Up to 3.5% |

| Tata Capital | 10.99% onwards | Up to 3.5% |

| Home Credit Cash Loan | 24% p.a. – 34% p.a. | 2.5%-5% |

| Ujjivan Small Finance Bank | At the discretion of the bank | At the discretion of the bank |

| Aditya Birla Capital | 14% p.a. -26% p.a. | Up to 2% |

| State Bank of India | 11.05% p.a. – 14.05% p.a. | Up to 1.50% |

| Karnataka Bank | Between 12% and 17% | At the discretion of the bank |

| Bank of Baroda | 10.90% p.a. – 18.25% p.a. | Up to 2% |

| Federal Bank | 11.49% p.a. – 14.49% p.a. | At the discretion of the bank |

| IIFL | 12.75% p.a. – 44% p.a. | 2% – 6% |

| Bank of India | 10.25% onwards | Up to 2% |

| (Fullerton India) SMFG India Credit | 11.99% p.a. onwards | Up to 6% |

| IDBI Bank | 10.50% p.a. – 13.25% p.a. | Contact the bank |

| Karur Vysya Bank | 10.75% p.a. – 13.75% p.a. | 0.50% onwards |

| South Indian Bank | 13.1% p.a. – 20.6% p.a. | Up to 2% |

| Indian Overseas Bank | 12.5% p.a. – 13.5% p.a. | Up to 0.50% |

| RBL Bank | 14% p.a. – 23% p.a. | Up to 3.5% |

| Punjab National Bank | 11.40% p.a. onwards | Up to 1.00% |

| Bank of Maharashtra | 10.00% p.a. onwards | Up to 1% |

| Central Bank of India | 12.00% p.a. – 12.75% p.a. | Up to 1% |

| City Union Bank | At the discretion of the bank | 1.00% subject to a minimum of Rs.250 |

| J&K Bank | 12.40% p.a. – 13.40% p.a. | Up to 1% of the loan amount subject to a maximum of Rs.10,000 |

Types of Interest Rates

Personal loans carry either fixed or variable interest rates. Having a fixed rate will keep your interest rate the same for the life of the loan, which can help with budgeting since it ensures that you will be making the same payment each month and month to month, these generally don’t change. Contrast this with a variable rate which can go up or down depending on where the market is.

Additional Fees

Aside from interest rates, borrowers should also consider possible origination fees for personal loans. These could be things like origination fees (collected by some lenders when you get the loan) and prepayment penalties (if you pay off the loan faster than expected). Makes Timely Payment of Scheduled Instalments, as Non Payment Shall Attract Late Payment Charges

Loan Tenure

The loan tenure refers to the length of time within which the borrowed amount must be repaid in full. Depending on financial institutions and individual circumstances, this period can range from just several months up to several years.

Shorter tenures, that are matched with lucrative monthly payments but lead to paying lesser interest over the years because let us face it, you have lesser number of repayment periods. In that regard, longer tenures generally drive lower monthly payments, but higher total interest cost, because more interest must be paid over an extended period of repayment.

Utilizing Personal Loans Effectively

Planning Ahead

It secures the use of the loan on its intended use whether it be on home improvements projects, bill consolidation or any other aspect of their budget. A plan will help keep individuals from quickly spending the money or accumulating unnecessary debt against the funds.

For example:

Anyone using the personal loan for home improvement should provide a breakdown of materials and labor costs.

The way to figure how much you need is to make a list of your debts, including the interest rate and term of the loans.

This makes people think about their borrowing requirements and also avoid borrowing more than they need to in the first place.

Responsible Borrowing

Borrow money responsibly, this includes using the right personal loans and makes sure you always repay your debts! This not only fulfills the financial obligations but helps in keeping or increasing ones CIBIL score.

For instance:

Paying off a personal loan every month is a clear signal of two things: maintaining fiscal control and having the balance to continue repaying the lease, even though you may not yet have your own vehicle.

Paying on-time helps credit report for a peer lending siteThis makes the credit report look better and you may pay less on future loans.

When individuals borrow responsibly, personal loans can be used as instruments to meet their financial goals and at the same time to prevent the financial portfolio from being ruined by ensuring good credit maintenance.

Debt Consolidation Benefits

Consolidation with personal loans has so many upsides – one of which is saving money on interest payments. An individual can pay off high interest debts such as credit card debt, with the aim of essentially replacing multiple payments with a single, (ideally) relatively less-costly payment combined with a lower interest rate compared to the typical APRs found in most credit card balances.

The Approval Process and Borrowing Limits

Application and Verification

To apply for a personal loan,

- The prospective borrower must submit an application. The lender would next look at the credit history and information regarding the financial position of the applicant.

- Additionally, they perform authenticity checks on all supplied information.

However, after its verification, the lender considers the borrower’s income, amount of debt they are already in and credit score in order to decide their credit line. This is how the lender assesses whether the borrower will pay back the loan on time or not.

For example:

When a person applies for a personal loan in a bank or online lending platform, they have to fill up an application with personal and financial information.

Pay stubs, tax returns, bank statements to prove income, and which may even ask for a tax transcript.

Determining Borrowing Limits

Before you even think about getting a personal loan, you first need to understand how much you can borrow. Before determining how much financial assistance they are capable of offering, lenders evaluate a multitude of elements. Plan collections by evaluating the borrower’s ability to repay debts at repayment time as planned in line with the existing financial condition.

This can depend on things such as whether you have a regular income, or generally how sensible you have been with your credit history that can dictate how much money you can borrow. This way, a small portion of the profits can be used as leverage to maximize your borrowing limits.

For instance:

An applicant with a good credit record (performing all previous loans and credit card payments on time, without having resorted to them or paying them too soon) p For instance, you will have a greater borrowing capacity.

Conversely, those with several existing debts for their level of income may face restrictions on how much additional borrowing they can take on, as lenders will have concerns about their ability to repay.

Alternatives to Personal Loans

Balance Transfer Credit Cards

If you are looking for other options for personal loans, you can go with balance transfer credit card. They enable customers to transfer high-interest debt onto a new card with a 0% APR introductory period.

It may be able to stop interest payments for a period of time and help to repay the money faster. But you always have to watch for balance transfer fees and the regular APR after the “intro” period ends, necessary or not.

Balance transfer credit cards is unsecured and no collateral is needed unlike other loan options. The potential credit down side: Individuals need a decent enough credit score to qualify for these cards, and being late on payments could result in penalty interest rates.

Home Equity Loans

Another thing you could consider are home equity loans. Home Equity Loans : These loans allow homeowners to borrow money against the value of their home. With an interest rate that is generally less than personal loans, fees are attached to the property, making this type of loan more attractive. In some cases, the interest paid on home equity loans can be tax-deductible.

But there are downsides as well if you go with a home equity loan in place of a personal loan. For example, if borrowers default on their payments, they can lose their homes in foreclosure because credit unions generally hold one or two mortgages on properties used as collateral.

Peer-to-Peer Lending

For borrowers who want to avoid traditional lenders, such as banks or credit unions, peer-to-peer lending is one option. This process involves borrowing money from individuals or investors via online platforms, instead of using traditional lenders.

A major advantage of peer-to-peer lending is that it can offer more favorable terms and lower interest rates than traditional bank loans, in part because individual investors are competing with one another for borrowers’ business.

However, not everyone will be suitable for peer-to-peer lending, as the same personal preferences of an investor will make approval biased, with highly skilled workers and people who make occasional credit card purchases perhaps being penalised for a market that operates according to the parameters of peer-to-peer lending reliant on income stability and prior transactions via credit card.

Looking for tailored financial solutions? Explore business loan in Coimbatore to support your entrepreneurial dreams and grow your business with ease.

Final Remarks

Therefore, when availing personal loans, an individual can make the best use of personal loans ensuring to not overshoot the borrowing limits, while still remembering the basics of interest, fees, and tenure. Additionally, those in need of financial assistance can also explore options besides personal loans for better views.

Frequently Asked Questions

What are the basic requirements for applying for a personal loan?

One would need to provide an identity proof and an address proof along with proof of income to apply for a personal loan. Credit History, and Employment Status May be Considered – Additional Details May be Necessary for Approval -erts.

What types of personal loans are available?

There are secured loans, unsecured loans, fixed-rate loans, variable-rate loans, debt consolidation personal loans and co-signer loans… and those are just a few of the types of personal loans. This type comes with its own strings attached which the borrowers need to review correctly.

How do interest rates on personal loans work?

Personal loan interest rates could be fixed or variable Fixed Rates: Fixed rates do not change throughout the life of the loan, while variable rates go up and down depending on the market conditions. For example, a persons credit score or the economic standing around the time of an individual may influence the rate they are offered.

Are there alternatives to taking out a personal loan?

In addition to using an existing savings or investment, other alternatives to personal loans include getting a home equity line of credit (HELOC), asking for help from family or friends, and exploring other types of financing such as credit cards with promotional offers.

How can someone effectively utilize a personal loan?

Typical reasons for using a personal loan include consolidating high-interest debt, paying for unexpected expenses (e.g. medical bills, car repairs), tackling home improvement/renovation projects, or funding a major to-do (e.g. a wedding, vacation).